DeFi's rapid growth proves it's the future of finance, providing investment...

Get the latest project updates from the Landshare Team

Get the latests insights and project updates from the Landshare team

By

Landshare Team

The advent of blockchain technology heralds a seismic shift in the real estate sector, promising unparalleled liquidity and accessibility through tokenizing real-world assets (RWAs). Traditionally we have seen the real estate sector as an illiquid asset class with high entry barriers but now it is reimagined by integrating on-chain secondary market trading of RWA tokens.

According to CoinMarketCap, the market cap of real-world asset (RWA) tokens stands above $53.7 Billion. This substantial market cap shows us that the RWA sector in the crypto market is proliferating. The high pace of growth ensures that it will soon overlay a notable portion of the traditional real estate market.

We can see how the RWA narrative has taken crypto space by the storm, and it has made a massive leap in the financial landscape. It is making tangible financial assets such as real estate investments more fluid, transparent, and accessible to a broader spectrum of investors. The amalgamation of RWA tokens with secondary market trading brings unprecedented advantages for you in the highly lucrative real estate investment sector.

We can understand secondary market trading as trading of assets among buyers and sellers rather than with the companies or projects. A budding project in the crypto space launches a token through either an ICO, IEO, or IDO, which primarily trades native tokens in exchange of raising funds from investors. After the launch, when these tokens are up for trade among traders, it becomes a secondary market, and the trading becomes secondary market trading.

NYSE and NASDAQ are, for instance, secondary market trading platforms, as they offer you to trade or invest in stocks. On the same note, trading on both centralized and decentralized crypto exchanges falls within secondary market trading. We can trade Bitcoin on crypto exchanges such as Coinbase or buy or sell Ethereum on decentralized exchanges like Uniswap.

Real-world assets (RWAs) refer to objects possessing tangible or intangible value, including but not limited to gold, fine art, and real estate. In 2024, the scope of these assets linked to the real world is set to broaden beyond the confines of physical space. The advancement of blockchain technology makes the expansion possessive, providing a unique on-chain identity to traditional assets. This innovation creates a novel concept known as the real-world asset token.

The global real estate market is over $630 Trillion today and is continually growing. It is expected to hit $729 Trillion by 2028. This also makes real estate investments one of the most lucrative investment vehicles due to huge returns, but they do come with their own shares of hassle.

The real estate market is illiquid, and even a single transaction of buying or selling a property could take weeks or even months. In addition, it takes time to complete the extensive paperwork required for a transaction, making the whole process inefficient.

With the introduction of real estate-backed RWA tokens, real estate property transactions can now be carried out faster, more transparently, and more efficiently. There's more to the phenomenon than just that; let's delve into the benefits of trading RWA tokens in secondary markets.

As mentioned above, the RWA crypto tokens already have a market cap of billions of dollars. Several projects are spearheading change within the space with unique propositions and offerings.

Landshare ($LAND) is among the rare projects that offer real estate-backed RWA tokens: Landshare RWA ($LSRWA). $LAND is the native utility and governance token that takes care of transactions and other operations over the platform.

The RWA token represents the unit of the pool of real estate properties 1:1. Landshare makes it possible for you to step into tokenized real estate investments with as low as $1. Landshare RWA tokens are playing a crucial role in changing the real estate investment landscape with unique propositions and offerings.

Landshare is actively tackling the challenge of the lack of secondary trading options for most security tokens with a comprehensive three-pronged approach. The strategy includes on-chain valuations, ensuring transparency with up-to-date property valuations and cash reserves; fixed price liquidity, maintaining token value alignment with the underlying assets through controlled sales; and DEX Trading, aiming to foster a vibrant secondary market for LSRWA tokens by enabling unrestricted trading.

The upcoming listing of LSRWA Tokens on the DS Swap Security Token DEX is a significant milestone in this endeavor for Landshare. The on-chain real estate trading by offering instant settlements, no transaction fees, and the flexibility to trade against LAND or stablecoin pairs will be possible and it's a paradigm shift in making.

The introduction of the DS Swap listing is expected to amplify trading dynamics by providing zero-fee liquidity pools, facilitating arbitrage opportunities, and allowing for higher trading limits. Landshare takes a leap in resolving the liquidity issues with the DS Swap Security Token DEX listing, promising a more fluid and accessible market for real estate tokenization.

Further enriching the ecosystem, Landshare plans to propose an LSRWA-USD liquidity pool, akin to the successful LAND-BNB LP, to incentivize LSRWA holders with rewards for contributing to liquidity. This initiative not only aims to elevate LSRWA's utility but also to broaden the trader base, mitigate price volatility, and ensure a more stable and liquid market environment.

The Path Forward: Innovation and Opportunities

The tokenization of real estate assets paves the way for innovative investment models and financing mechanisms, from crowdfunded investments to yield-generating real estate funds. These developments promise to enrich the investment landscape and provide property owners and developers with novel avenues for funding and growth.

The listing of LSRWA Tokens on the DS Swap Security Token DEX represents a pivotal moment for Landshare, a huge change in on-chain real estate trading. Enabling instant settlements, zero transaction fees, and versatile trading against LAND or stablecoin pairs, this step will bring unprecedented liquidity in the space. It amplifies trading dynamics with zero-fee liquidity pools, arbitrage opportunities, and higher trading limits, marking a significant step towards solving liquidity issues and enhancing the accessibility of real estate tokenization.

RWA tokens' on-chain secondary market trading sets the stage for a more liquid, inclusive, and dynamic real estate market. By leveraging the power of blockchain technology, the real estate sector is poised for a transformation that promises to redefine the essence of property investment, making it more accessible, efficient, and attractive to a global audience of investors.

The future of real estate investment is not just about owning property; it's about being part of a revolutionary movement toward a more democratized financial ecosystem.

By

Landshare Team

The world is moving fast and every now and then we see disruption in traditional industries by emerging technologies. Blockchain is undoubtedly a state-of-the-art technology which is changing the landscape across the industries. It keeps changing the fundamental operations and bringing better and efficient solutions. Tokenization of Real World Assets (RWAs) is possible due to blockchain technology and is on the way to becoming a trillion dollar industry.

The RWAs could include a wide range of assets from the tangible financial or traditional physical world including real estate, commodities, artifacts, or even the digital tokens, the list goes on for real world assets. Although we are witnessing that the tokenization sector is on boom and spreading across different sectors, it is making a notable difference in real estate. A significant number of projects have surfaced in recent years that focus on tokenization of the real estate sector.

Industry experts have recognized tokenization as an enterprise blockchain solution with huge potential in the future. Co-founder of crypto exchange Coinbase Fred Ehsram quotes that “Everything will be tokenized and connected by a blockchain one day.”

Tokenization is a process of representing the value of real world assets on blockchain. When an asset is represented as a digital token that can be exchanged and kept on a blockchain, this process is known as tokenization. We do not need middlemen, while secure and transparent record-keeping is made possible by distributed ledger technology, or blockchain.

Real World Assets (RWAs) includes tangible assets such as real estate properties and art pieces, financial instruments such as commodities, bonds, and equities and intangible assets intellectual property, data and identity.

Data suggests that RWA tokenization emerged as a fast-paced segment across the DeFi space. According to DefiLlama, in December 2023, the RWA tokenization was sitting on total value locked (TVL) of around $5 Billion.

Increased liquidity, fractional ownership, and easier transferability are just a few advantages that blockchain-based tokenization offers over conventional asset ownership and trade. Tokenized assets can be exchanged anywhere in the world, at any time, and without middlemen, which lowers expenses and expands the pool of possible investments.

Though tokenization is a typical procedure with technological aspects, still here we try to give a simple explanation. The tokenization process begins with determining the best method to digitize the chosen asset, which varies based on the asset's nature, such as a money market fund versus a carbon credit, and its classification as either a security or a commodity under relevant laws.

Next, if the asset has a tangible form, it is secured in a mutually agreed-upon location. Following this, a token representing the asset is created on a blockchain, with necessary compliance measures in place. This digital asset is then ready for distribution, requiring investors to use a digital wallet for storage and possibly trade on a secondary market with less stringent regulations.

Post-distribution, the asset undergoes continuous management, including compliance with legal and financial reporting, to ensure its integrity and value are maintained.

RWA Tokenization is taking the world by storm and there are a number of reasons behind it in the form of benefits and offerings. It solves many inherent issues across the sectors along with bringing new age solutions. The solutions not only saves cost and efforts but end up making the traditional procedure more efficient and easy. Let’s talk about the advantages of RWA tokenization in depth.

Accelerated Settlements Through Constant Availability: Traditional financial settlements typically take up to few business days to complete, allowing time for all parties to prepare necessary documents and funds. Tokenization enables immediate settlements, offering potential savings, especially in environments with high interest rates, by facilitating round-the-clock transactions.

Reduction in Operational Expenses with Programmable Assets: Tokenization brings significant cost reductions in asset management, particularly for assets that traditionally require extensive manual intervention, like corporate bonds. By integrating functions such as interest computation and payment distributions into a token’s smart contract, these processes become automated, minimizing the need for manual oversight.

Opening Investment Opportunities to a Wider Audience: The efficiency gained from automating complex and labor-intensive processes makes it financially viable to serve a broader range of investors, including those with smaller capital. However, for this democratization to fully materialize, the distribution of tokenized assets must expand substantially.

Boosted Transparency Through Smart Contracts: The deployment of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, enhances the transparency of transactions. For instance, in the case of tokenized carbon credits, the blockchain can maintain a clear, unchangeable record of the credits' ownership and transactions.

More Flexible and Cost-effective Infrastructure: Leveraging blockchain technology, which is open source by nature, results in a more adaptable and less expensive infrastructure compared to traditional financial systems. This aspect of blockchain facilitates quicker adjustments to meet evolving regulations or operational demands.

The landscape of RWA tokenization, or digitizing tangible assets through blockchain, is at a foundational stage with a promising outlook. As the underlying blockchain technology evolves and legal frameworks become more defined, this area is poised for notable expansion. RWA tokenization issuance is forecasted to reach $4 to $5 trillion by 2030.

Here's a snapshot of emerging trends in the realm of RWA tokenization:

Wider Acceptance: Anticipate a surge in the embrace of this innovation across diverse industries. Companies leveraging this approach stand to gain by making assets more liquid, slashing operational expenses, and widening the pool of potential investors.

Legal Frameworks Gaining Shape: The growth trajectory of RWA tokenization hinges on clear legal guidelines. Authorities are progressively understanding the value of these digital assets and are crafting laws to safeguard investors while promoting creative advancements.

Cross-Platform Exchangeability: The fluid exchange of tokenized assets among various blockchains and platforms is essential for the sector's vitality. Efforts are underway to establish norms and protocols that enable such seamless transfers, aiming to boost market liquidity and effectiveness.

Security Enhancements: With the rise in the value of digital assets, enforcing stringent security protocols is becoming increasingly crucial. Cutting-edge solutions, including decentralized verification and layered authentication measures, are being developed to fortify the safety of these assets.

DeFi Convergence: The intersection of RWA tokenization with the burgeoning sector of DeFi heralds the creation of innovative financial mechanisms. This amalgamation is set to offer unprecedented opportunities for decentralized financial activities, from lending and borrowing to generating passive income.

These evolving dynamics suggest a transformative phase for the tokenization of real assets, promising to redefine the contours of asset management and investment through increased accessibility, security, and market fluidity.

There are a number of industries that saw a significant interest in tokenization of assets. The real estate sector has swiftly acknowledged the advantages offered by tokenizing. Transforming tangible real estate into digital tokens enhances trading efficiency and liquidity. This innovation provides investors with fresh opportunities, reduces entry obstacles, and enables partial ownership of premium properties.

In addition to real estate, tokenization is transforming investment in art, collectibles, private equity, commodities, and venture capital. It democratizes access to high-value art and collectibles by allowing fractional ownership through digital tokens, enhancing portfolio diversification.

In private equity, it streamlines capital raising and increases asset liquidity, making it easier for investors to trade shares in private companies. For commodities like gold and oil, tokenization offers a simplified trading mechanism, bypassing the need for physical handling. In venture capital, tokenizing startup equity facilitates capital raising and provides early-stage investors with liquidity, allowing them to realize returns without waiting for traditional exit events.

Avalanche is emerging as a key player in the RWA tokenization space, attracting major banks like JP Morgan, Citi, and Bank of America. These institutions are leveraging Avalanche's technology and Subnets to develop blockchain solutions for tokenizing funds, facilitating forex trades, and exploring broader asset tokenization opportunities.

Chainlink plays a crucial role in the tokenization of real-world assets, offering transparency, cost-effectiveness, and accessibility in financial transactions. Research by K33 highlights Chainlink's LINK as a secure choice for investors interested in RWAs' tokenization. Chainlink's platform enables the enrichment of RWAs with real-world data, secure cross-chain transfers, and connection to off-chain data, making it a key player in this emerging landscape.

The real estate sector market is one of the fastest growing industries worldwide. Statista report states that in 2021, the global real estate market size stood at $585 Trillion. It is expected to be a staggering $729.4 Trillion in 2028 with a CAGR of 3.4%.

Given the sheer size of the industry, tokenization of real estate has a huge potential in the near future. There are several projects already active in the space leading the way for the industry. We at Landshare intend to unlock the vast prospect of real estate for the masses.

Landshare stands out in the real estate tokenization sphere through its innovative and reliable unique selling points. Our ability to successfully sell three properties via the Binance Smart Chain (BSC) highlights our operational proficiency and the market's endorsement of our approach.

The introduction of our Real World Asset (RWA) token, Landshare RWA ($LSRWA), opens up new opportunities for investors aiming for diversification and passive income. This token allows investors to access a selection of properties. Our platform's functionality and transactions are significantly supported by our native utility token, $LAND.

Beyond the fundamental benefits of tokenized real estate, we offer additional perks that enhance its appeal. Holding $LAND enables us to offer investors returns over 12%, while participating in $LAND-$BNB LP stake can yield rewards as high as 66%. Landshare's commitment to innovation, security, and profitability continues to propel us forward in the tokenized real estate market.

Real estate tokenization transforms property investment and management through several key benefits:

Enhanced Liquidity: Tokenizing real estate allows for the fractional buying and selling of property interests, significantly increasing market liquidity. This process enables smaller investments and makes it easier for owners to sell parts of their assets quickly, offering flexibility previously unseen in the traditional real estate market.

Accessible Fractional Ownership and Diverse Portfolio Opportunities: Democratization of real estate investment becomes possible by lowering entry barriers and enabling portfolio diversification across various properties and locations, thus reducing risk and potentially enhancing returns for a broader investor base.

Participation in Global Real Estate: Tokenization erases geographical boundaries, enabling global investment in local real estate markets. This not only broadens the investor base but also injects foreign capital into markets, potentially stabilizing property values and encouraging economic diversity.

Efficiency, Transparency and Low Transaction Fees: Tokenization enhances transaction efficiency, reduces costs, and speeds up processes by eliminating traditional bottlenecks and paperwork. It ensures transparency, recording every transaction to minimize fraud risks, thereby building investor trust. Additionally, it cuts down on intermediary fees, making investments more accessible and profitable.

Simplified Asset Management: Digital tokens simplify the management of real estate assets, from leasing to maintenance and sales. This efficiency reduces administrative burdens and costs, potentially increasing the profitability of real estate investments.

These advancements collectively represent a significant shift in how real estate is viewed, traded, and managed, offering unprecedented opportunities for investors and transforming the real estate landscape into a more inclusive, efficient, and secure market.

The tokenization of Real World Assets (RWAs) represents a groundbreaking shift in how we view and manage assets across various industries. With its roots deeply entrenched in blockchain technology, tokenization is paving the way for a more efficient, transparent, and accessible market. The real estate sector, in particular, has seen a remarkable transformation through tokenization, offering benefits like increased liquidity, fractional ownership, and global participation. As we look towards the future, the potential for tokenization extends far beyond real estate, touching every corner of the investment world from art and commodities to intellectual property.

Landshare's initiative in real estate tokenization exemplifies the practical application and immense potential of this innovation, demonstrating how traditional barriers can be dismantled to unlock new investment opportunities. With the global real estate market poised for significant growth, the role of tokenization will undoubtedly expand, bringing with it a host of advancements in how we buy, sell, and manage assets. As industry leaders and pioneers continue to explore and invest in tokenization, the landscape of asset management is set for a revolution, making investment more democratic, secure, and efficient for all.

.png)

By

Landshare Team

Inflation is an economic phenomenon that shows the rate of increase in prices over some time. Typically, inflation is a broad measure, including the overall price increase or the cost of living in a country. It affects the purchasing power and could be severe across countries. In general, inflation is considered to eat away savings over time and, in most cases, even the profits of your investments.

Since inflation could be fatal enough to diminish your profits, picking and choosing the assets that can give it a tough battle becomes crucial. And bear in mind that it should also beat it. In the long history of investments, real estate investments have proven their worth regardless of how bad the odds were. Experts have always believed that real estate is a hedge against inflation. An advent of tokenized real estate is also taking place in mainstream discussions.

In today's fluctuating economic landscape, safeguarding your investment portfolio against inflation is more crucial than ever. As inflation erodes purchasing power and diminishes the actual value of money, experts frequently turn to real estate as a robust shield against these forces. This blog delves into why real estate is a bulwark against inflation, particularly its tokenized form.

The increase in prices of commodities, assets, or anything that can be purchased is inflation. The purchasing power of a currency decreases due to increasing inflation. For instance, consider the inflation rate in the United States at 3%. If you buy a toothbrush for $20 today, you would buy it for $20.6 the next year and $21.2 the following year.

What should a 60 cents or $1.2 increase affect? The difference may not seem significant, but inflation is a burning issue since it burns purchasing power and, ideally, sitting savings.

There are multiple factors to measure inflation in any given region or country. In the United States, there's the Consumer Price Index (CPI) that measures inflation. To gauge inflation, changes in commodity prices are tracked, and how much a customer pays for a basket of certain consumer goods is observed. Not all products or commodities see a price increase; some get cheaper, too. The mean cost of all the commodities brought us the inflation rate.

Inflation affects investments in general to a large extent. Since the purchasing power decreases with soaring inflation, people prefer to pay for the basic requirements at present over making investments to generate profits in the foreseeable future. Now that the investments are less, the profit is even smaller, triggering a vicious cycle.

According to Goldman Sachs, "inflation can be a friend to real estate." This is true because the construction cost rises with increasing inflation, resulting in the appreciation of property prices. 2023 was uncertain where the world was moving towards inflation while the governments across countries worked to curb the rising prices, and a looming recession was on the other side.

Macroeconomics evolved frequently during those times, and it became necessary for investors to keep their portfolios stable with some stable investment vehicle, such as real estate. Historically, the real estate market has proven its worth when weathering softer economic situations.

The real estate market mostly runs ahead of inflation or at least follows it to a large extent, depending on the region. Construction cost is among the reasons behind appreciation in the real estate market. At the same time, demand and supply are crucial factors in deciding the price, as they do for every other product or service in the market.

Within the diverse array of investment options available today, including stocks, physical gold, gold ETFs, commodities, and floating-rate bonds, each presents its own set of advantages and drawbacks when it comes to hedging against inflation. However, real estate stands out as a historically reliable safeguard against inflation.

Global data since 1980 shows that commercial real estate has surpassed other investment classes in six out of seven inflationary cycles, showcasing its resilience in preserving value and performance amidst inflationary pressures. Inflation leads to a significant rise in the costs associated with constructing new properties, elevating the importance and value of existing properties. This scenario enhances the potential for increased rental income and improved liquidity from a real estate investment standpoint.

Now that you are convinced that real estate investments win over inflation, let’s talk about the changing landscape of real estate investments. The industry is witnessing a paradigm shift due to technological advancements. Tokenization is the process of bringing tangible real world assets (RWA) to blockchain technology. These assets include tangible financial investments such as commodities, currencies, and real estate.

The real estate sector is moving towards tokenization with higher speed. The market size of tokenized assets can hit $10 Trillion by 2030, whereas the real estate tokenization market could swell to over $18 Billion by the end of this decade. Tokenized real estate investments make traditional investment methods better and more efficient. Entering the real estate sector becomes less complicated, needs less or no paperwork, and comes with better transparency and liquidity.

A huge number of projects emerged in the past few years, such as Landshare, Centrifuge, Maple, Pendle, and several others. These projects are involved in tokenization of RWAs.

Tokenized real estate brings more advantages than existing benefits of real estate investments. Tokenization of real estate makes fractional ownership of property possible. It lowers the threshold, making it feasible for many investors to foray into the real estate landscape. The investor base increases significantly, and more investors bring more liquidity.

Landshare is highly active in the tokenized real estate sector selling three properties on the Binance Smart Chain (BSC). The native Landshare RWA (LSRWA) token facilitates a pool of properties for users to invest in real estate. Other similar projects are holding the baton of tokenized real estate and making a mark.

Real estate's tangible nature and the advent of tokenization have solidified its position as an unbeatable hedge against inflation. By offering tangible assets that appreciate over time, coupled with the innovative tokenization approach, real estate stands as a fortress for investors seeking to protect their portfolios from inflation's erosive effects.

As we move forward, the fusion of traditional real estate investment with blockchain technology promises to redefine the landscape of inflation-resistant investments. Tokenized real estate, with its unique blend of accessibility, efficiency, and scalability, is at the forefront of this evolution. It offers a promising avenue for investors aiming to weather the storm of inflation.

.jpg)

By

Landshare Team

The financial markets worldwide are witnessing paradigm shifts with inclusion of emerging technologies. Mckinsey report says that the new-age fintech has surged from the periphery to dominate financial services, with its market cap hitting $550 billion by July 2023, and the number of fintech unicorns reaching 272, valued at $936 billion. This growth, driven by innovation, digitization, and changing consumer demands, has seen fintech reshape financial services.

We look at traditional investment sectors such as real estate and commodities markets that are also poised for transformation. One of the technological advancements that emerged recently is tokenization.

The global real estate market is valued in trillions of dollars, yet it's characterized by low liquidity and high entry barriers. Tokenization is poised to unlock the value of illiquid assets and make them accessible to a wider range of investors.

For the real estate market which is worth a whopping $600 Trillion as of now, tokenization is a game changer that can contribute to the sector’s growth and eliminate inefficiencies to a large extent. Several cryptocurrency projects, such as Landshare ($LAND), have also emerged in the past several years dedicated to the tokenization of the real estate sector.

Let’s dive deeper into the subject and try to understand what is on the other side of the innovative intersection of real estate and blockchain technology and how Landshare-like platforms play a crucial role in achieving success.

Tokenization is a process of issuing a digital representation of an asset over a blockchain. The process ensures digital representation of tangible financial assets over blockchain. A tokenized version of a physical asset does not only keep the inherent traits but also eliminate the shortcomings.

The process of tokenization includes token issuance, sale of the token, and then custody of the security token. However, the process of ownership includes asset’s going through tokenization which is then divided into a certain number of tokens where each token represents a percentage of the property possession.

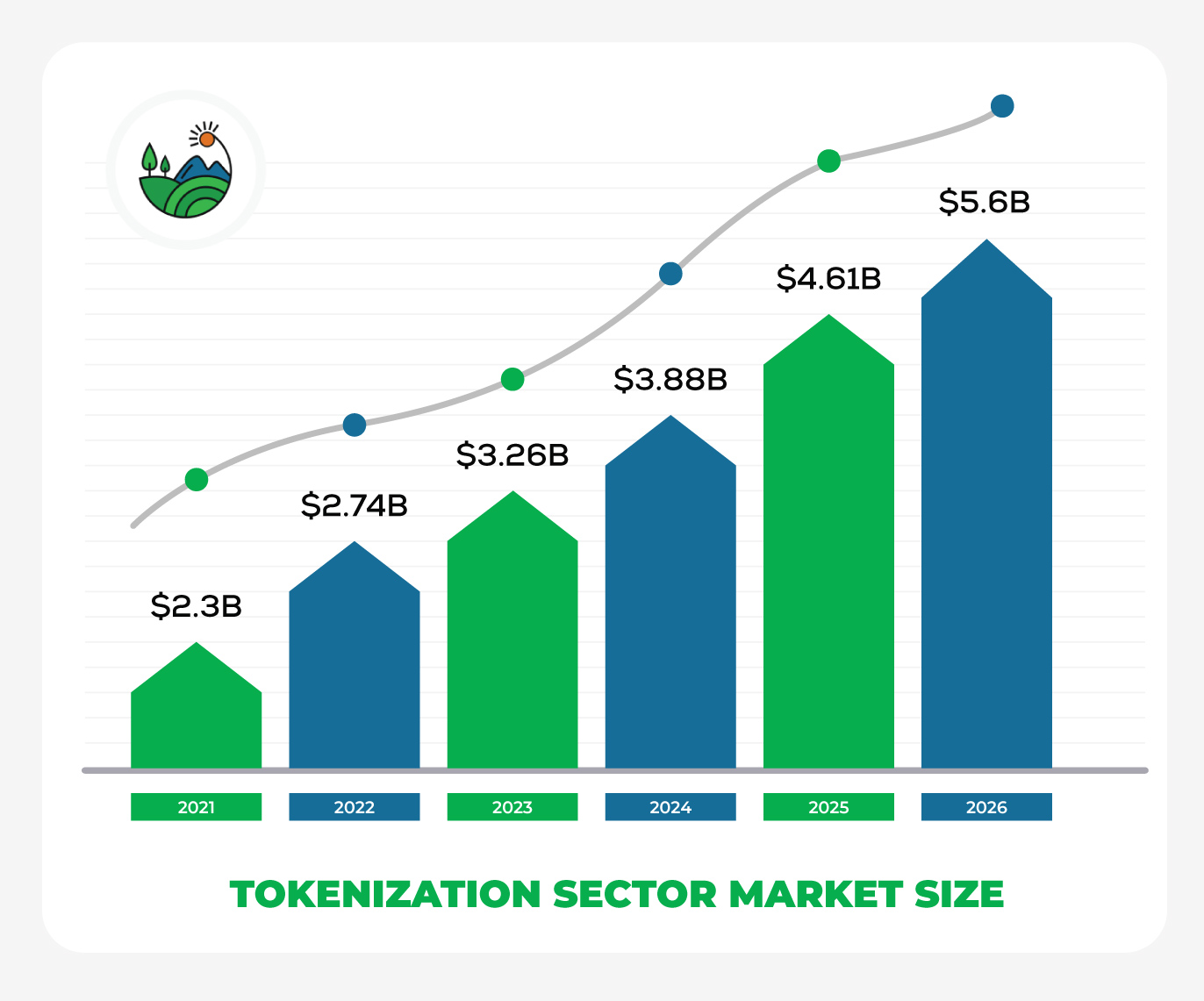

The market size of tokenization was $2.3 Billion by 2021 but the sector is likely to see significant growth in the future given the expected compounded annual growth rate (CAGR) of 19%. The market size could swell up to $5.6 Billion by 2026.

In terms of real estate tokenization, any property can be converted into security tokens over blockchain. These tokens would now represent the value of a unit of real estate property. The popular term for such tokens is Real World Asset (RWA) tokens.

Traditionally, the buying and selling of real estate properties comes with much of a hassle. First up it requires a hefty amount of upfront capital to buy the asset. It takes a lot of time and effort to do paperwork for the property handover. The process is not transparent and there’s always a scope of oversight. Also, there are a lot of constraints for a buyer willing to buy a foreign property.

Tokenization of the real estate market brings unprecedented advantages for one of the biggest investment sectors in the world. Real estate investments are among the few investments with lucrative yet stable returns. The tokenized version brings additional features making it even more attractive.

Tokenized real estate investments are different from traditional real estate investments. However, the differences do not make any one of them superior then the other. Instead, the tokenized real estate is only going to complement the traditional sector. The comparison between the two should clear the picture to a large extent for better understanding.

Though tokenization has noteworthy benefits, there are several challenges in front of the growing sector that needs to be addressed.

Regulatory compliance becomes one of the hurdles in front of real estate tokenization. Since it's an emerging market, the regulatory bodies across the countries might still need some time to come up with regulations to keep the scrutiny without compromising on the sector's growth.

Akin to regulatory compliance, the newness of the tokenized real estate market makes it relatively tough for people to accept. The financial markets are still figuring out and may take time to completely trust and accept the new investment vehicle.

The global real estate market is expected to hit a staggering value of $637.8 Trillion in 2024. The projected annual growth rate is 3.4% CAGR. And considering the expected growth rate, the real estate market is going to be worth $729.4 Trillion by 2028.

A report by the World Economic Forum predicted that by 2027, 10% of the world's GDP will be tokenized — with a significant portion of this potentially in the real estate sector. To put this into perspective, world GDP in 2027 is expected to hit $130 Trillion and hence the tokenized asset market will be worth around $13 Trillion. This number suggests a huge growth potential for the tokenized market in the coming years.

The Landshare Ecosystem takes a unique approach to tokenized real estate, combining the benefits of RWA investment with the opportunities provided by DeFi features such as staking and LP Farming.

Our approach to the real estate tokenization market is underscored by our unique selling propositions, reflecting both innovation and reliability. The successful sale of three properties on the Binance Smart Chain (BSC) serves as a concrete demonstration of our operational capabilities and market acceptance.

Furthermore, the launch of our Real World Asset (RWA) token, Landshare RWA ($LSRWA), introduces new avenues for investors seeking diversification and passive income. RWA tokens represent a pool of properties for you to invest in at once, reducing risk through diversification.

For instance, we acquire a real estate property in Cleveland for $118,000 and add the asset to the RWA Pool. Each RWA Token represents a share of the total pool, providing a clear and tangible stake in the investment.

Our native utility token, $LAND, plays a crucial role in transactions and operations across the platform.

In addition to the core advantages of tokenized real estate, we bring forth extra features for DeFi-centric users. By staking the $LAND token, investors can earn 12% APR, while engaging in staking with $LAND-$BNB LP presents the potential for rewards up to 66%.

The financial markets are undergoing a transformative shift with the advent of technologies like blockchain, particularly in the real estate sector. Landshare and similar platforms are at the forefront, merging blockchain with real estate to enhance accessibility, efficiency, and transparency.

Tokenization is revolutionizing investment by making real estate more accessible and liquid, signaling a future where investing in tangible assets is more democratized. We, at Landshare, are playing our role in this evolution, demonstrating the potential of tokenized real estate and its significant economic implications. This movement isn't just a trend but a pivotal change set to redefine investment landscapes globally.

.png)

By

Landshare Team

Hello everyone, and welcome to the latest Development Update! It’s been a little over 2 months since we released the Landshare RWA Token, our most ambitious platform update yet. This update was the result of several months of hard work from the whole team, but we knew it only represented the first step in building the tokenized real estate ecosystem that we envision for Landshare.

After the successful launch, we immediately started thinking about what we needed to accomplish next to continue moving Landshare. As a result, we crafted 4 Core Priorities for 2024:

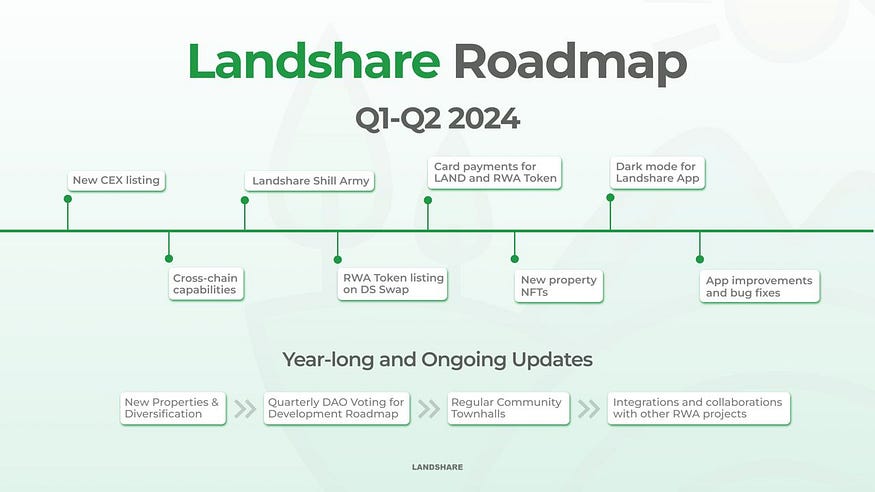

Each of our 4 Core Priorities are represented in our Q1-Q2 Roadmap:

In this update, we’re putting a special spotlight on our upcoming partnerships and integrations with several amazing projects across the RWA Space. We also have a major update on one of our top initiatives to improve platform accessibility, some new DAO proposals, and a new quality-of-life update about to go live.

Finally, we have an important update for all Gate.io users and traders.

Let’s dive in!

Rapid onboarding is paramount to a deeper level of engagement with the platform, and one of the biggest hurdles to new users is funding gas tokens for a DEX swap or signing up for a new exchange account. As a result, credit card payment options have been on our radar for a very long time.

As part of our 2024 Roadmap, we’re finalizing an agreement with a trusted crypto payment processor to finally enable credit and debit card payment options for our platform! This integration will enable eligible users to purchase up to $500 in LAND directly from the website or app, eliminating one of the most common barriers for new users.

The card payment option is expected to go live next week and will initially support only the LAND Token. However, we’re also working to enable LSRWA purchases through the same process. Stay tuned!

After many requests from the community and a successful DAO vote, we’ll be adding a dark mode option to the app in the coming days. To enable dark mode, scroll to the bottom of the page and move the slider to the nighttime position when the update goes live.

A new proposal has hit the Landshare DAO, designed to create a referral system for Landshare RWA Tokens. Here is a summary of the proposal:

Why should we implement a Referral System?

As we strive to enhance user engagement and expand our user base, it’s essential to leverage the power of referrals, because this is one of the best Marketing Tools that exist. One other Positive is, that you only pay for the Marketing when the user did the Action — in this case, he buys the $LSRWA-Token.

How exactly could that work?

Im thinking about a PPL (Pay Per Lead) Programme, where the refferer is reffering a new user to buy $LSRWA-Tokens. The referrer would then be rewarded after the reffered person held the $LSRWA Token some time (1–6 Months perhaps). This additional Time is neccessary to frontrun abuse of the System.

We could also give the referred Person a little benefit (discount, NFT, whatever) for his 1st Purchase, after he held some time, to make the System even more attractive.

How to finance?

This could be financed by a part of the normally burned Land Tokens (of every buy) for example. Instead of burning the full 10% of $LAND of a Buy, we could just burn 7,5% and the remaining 2,5% goes to the refferer as a reward.

Click here to read the full proposal and cast your vote. If passed, the team will construct a refined version of the proposal for the Quarterly DAO Vote at the end of Q1.

Over the past several months, we have been in discussions with dozens of amazing projects in the emerging RWA space. We always seek new opportunities to expand our product accessibility, utility, and visibility through integrations and partnerships. In this section, we’ll be covering a few of our future integrations, but as always — there’s more to come!

The future of markets is on the blockchain, and the future of blockchain is cross-chain. It is more important than ever to develop applications that are seamlessly interoperable across multiple blockchain networks. We envision the Landshare RWA Token as a DeFi-integrated, omni-chain asset for the tokenized future.

The first step in this process is the integration of Chainlink CCIP, a secure blockchain interoperability protocol built by Chainlink Labs. CCIP enables seamless cross-chain token transfers and allows us to craft a multi-chain ecosystem. When fully integrated, most or all features available on BSC will also be available on all other supported chains.

Once implementation is complete, CCIP will allow us to build partnerships and integrations with virtually any project across the RWA Space, improving the utility and accessibility of our core features. Integrations are one of our 4 Core Priorities for the year, and CCIP is the crucial first step to unlocking these opportunities.

Plume is the first modular L2 blockchain dedicated to all real-world assets (RWAs) that directly integrates asset tokenization and compliance providers into the chain.

We recently had a Twitter Space with Plume’s co-founder, Teddy, and have had additional discussions with the Plume Network team behind the scenes. We are excited about their vision and are planning to build on the Plume Network as part of our broader cross-chain strategy.

Plume is still in the Testnet phase, but we are looking forward to building with them all the way to the Mainnet launch. Stay tuned for more announcements regarding this partnership soon!

IX Swap is an RWA platform that offers trading solutions akin to Uniswap for Real-World Assets (RWA) & Security Tokens (STO). This is precisely the type of product we feel is necessary for the development of a vibrant RWA ecosystem, so we knew IX Swap was a perfect fit.

Initially, we will be collaborating with IX Swap for Twitter Spaces and other activities to spread the word about the RWA narrative and how DeFi primitives like decentralized exchanges (DEX) can help craft a tokenized economy for the future. Later this year, we plan a full integration, including LSRWA integration into the IX Swap ecosystem.

Gate.io will be changing our token symbol from LAND to LANDSHARE and plans to take the deposit, withdrawal and trading services for Landshare (LAND) offline, including spot trading, quantitative trading, and liquidity mining on February 28, 2024, 06:00 A.M. UTC. After the renaming is completed, Landshare will be relisted with the new token symbol LANDSHARE.

This renaming is merely a change in name and does not involve any blockchain migration. Gate.io users don’t need to do anything in particular. To read the full announcement post from Gate, click here.

To wrap up this development update, we want to sincerely thank our community for their continued support and enthusiasm. The past few months have been incredibly productive, and our upcoming integrations will take us one step closer to a fully realized tokenized real estate ecosystem.

We also understand that many members are eagerly awaiting news about new exchange listings and other developments not mentioned in this post. Rest assured, we are working hard to deliver the entire roadmap in the expected time frame and will have more information to share in future updates.

Last but not least, we’d like to extend a warm welcome to all of our new community members! We’ve seen some exceptional growth in recent weeks and expect to see this trend continue as the RWA narrative continues to gain momentum. If you’re new or have been away for a while, be sure to check out our guides to learn about all the ways you can earn with Landshare’s ecosystem:

As always, if you have any questions, concerns, or suggestions, don’t hesitate to reach out to us on our Telegram group or other social media channels. Remember — your participation and feedback are vital to the success of Landshare!

Follow Landshare:

Twitter | Medium | Youtube | Telegram | Telegram Announcements | Coinmarketcap | Zealy

By

Landshare Team

As the year winds down, we’re immensely grateful to our dedicated community members, collaborators, partners, and everyone who has worked with us as pioneers in the RWA space. 2023 was a year to remember for Landshare, and we have even bigger ambitions for 2024!

In this article, we’re capping off 2023 by celebrating the year’s top achievements, outlining our core priorities going forward, and providing a detailed roadmap for the first half of 2024. Let’s dive in!

Early this year, we completed the first ever tokenized house flip, netting a 10%+ ROI in just a few months for our participants. In this process, we transformed a distressed property into something brand new, drastically increasing the property value. You can read about the renovation from start to finish in our Follow the Flip series.

This year also marked the launch of the Landshare DAO, which puts high-level decisions into the hands of LAND holders through a decentralized governance model. With this feature, LAND holders can control token emissions, staking rewards, treasury funds, and launch marketing initiatives autonomously.

To learn more about the Landshare DAO and how you can help shape the future of Landshare, be sure to check out our Deep Dive article and the Landshare Docs.

At the end of September, we launched an extensive community incentive program with a prize pool of 35,000 LAND tokens. During this period, we achieved 2.5 million impressions on social media, gained 1200 new token holders, received over 3000 registrations on the DS Dashboard, and welcomed several thousand new followers on X and Telegram community members.

This Friday, December 29th, we officially conclude the Zealy Sprint, marking the completion of the Real World Explorers program. The top 215 leaderboard participants will receive delightful New Year gifts from a 4,000 LAND prize pool.

We thank each explorer for their contributions and eagerly anticipate the opportunity to share what we have in store for the Landshare Shill Army.

To finish 2023 with a bang, we released our most ambitious update yet — the Landshare RWA Token!

With this new token, we’ve fundamentally reimagined our tokenization model, establishing a simple and secure way to gain exposure to real estate directly on-chain. Along with the new Token, we’ve introduced on-chain property valuations via Chainlink, new secondary trading market options, a UI/UX overhaul, and substantial improvements to the NFT ecosystem.

For more information about the RWA Token Update, be sure to check out the following resources:

With the final days of 2023 ticking away, we’re setting our sights on the agenda for the new year. We have established 4 Core Priorities for 2024, each of which will guide our decisions throughout the year. Our roadmap is built as an extension of these priorities, with each item serving to advance one or more of them.

Over time, we have discovered that the most effective way to increase visibility and engagement with the platform is through grassroots, community driven programs and insightful write-ups from Key Opinion Leaders across multiple platforms. To this end, we’re crafting several new initiatives designed to increase visibility and leverage the power of community.

As part of the Real-World Explorer program, we frequently conduct shilling quests where users share information about Landshare, thereby boosting awareness of our updates and events. While this approach has been effective, we recognized the need for a modernized version, and that’s exactly what we’ve achieved with the Shilling Army.

We’re now going beyond mere likes and retweets, delving into more meaningful engagement. We’ve created distinct categories for creatives, influencers, shillers, and a plethora of user-generated content that will be ready to launch in mid-January. More details about this campaign, including information on how to participate and fulfill requirements, will be shared tentatively on January 16. Stay tuned so you don’t miss out.

As many influential voices in the crypto space focus in on the RWA narrative, it’s crucial to continue our work with Key Opinion leaders across the crypto space. We are focused on creators who craft well-researched, highly informative content which clearly highlights the benefits of our platform in a way that is accessible to a wide audience.

Many of our community members may be familiar with the DAO Grant Program and content creation contests. In 2024, we’ll be doubling down our efforts, engaging community members and up-and-coming content creators to produce high-quality, insightful content across multiple domains.

Next up, we must ensure that the platform’s features are easily accessible and well-integrated with other projects. By breaking down barriers to entry and expanding integrations, we make it easier to get into Landshare and even improve the project’s visibility in the process.

Although decentralized exchanges (DEXes) like Pancakeswap are a backbone of DeFi, many users prefer centralized exchanges as a way to buy and sell tokens. To make it easier for these users to get started with Landshare, we intend to list the LAND token on a new centralized exchange early in the year. This will not only allow us to reach more users, but also improve liquidity and opportunities for existing LAND holders.

As crypto moves to an increasingly multi-chain and cross-chain future, it’s imperative that our platform features are accessible through multiple chains. Cross-chain is one of our top priorities, and has been on the radar for a long time. With our latest platform updates as well as new advancements in cross-chain protocols, we have finally established a clear path towards a multi-chain Landshare ecosystem.

With cross-chain comes multiple benefits, including new partnership opportunities, wider access to platform features, and enhanced security. As one of our top priorities for H1 2024, we will continue to provide updates on the development of this feature, including a deep dive article in the coming weeks.

After taking a major step forward with on-chain valuations [link] and fixed price liquidity for RWA Tokens, we will further expand secondary market options with a DS Swap listing for LSRWA. DS Swap will enable the exchange of LSRWA in an active secondary market, similar to Pancakeswap or Uniswap.

Funding a Web3 wallet like Metamask can be a major hurdle for DeFi newcomers. In order to smooth out the onboarding process, we intend to enable credit and debit card payment options for the LAND Token.

Our development will also be hard at work crafting new features and updates for the Landshare App. In addition to some new features yet to be announced, here are the top priorities for our development team entering in the new year.

In the very near future, we will be completing the NFT migration process for existing NFT holders. With the new system, RWA Token Holders will be stack multiple NFTs for a single yield multiplier against their staked RWA Tokens.

Shortly thereafter, we will release our 3rd NFT for the newest Landshare property, LSCH. With this launch will also come a number of promotions and events designed to bring new users into the Landshare NFT ecosystem. With all 3 NFTs in possession, RWA Token holders can earn 40%+ APR in addition to the gains from rental yields and appreciation!

Dark mode has been a commonly requested feature and was passed via DAO proposal with an 81% vote. Accordingly, we will be launching this feature for the Landshare App early in the year.

Our recent Bug Bounty produced some excellent reports and feedback from the community. Our development team will be hard at work fixing existing bugs and making improvements to the Landshare App based on the feedback provided.

Bringing LAND and LSRWA to multiple chains is beneficial unto itself, but far less valuable if key features like staking, governance, and NFTs are not available on those other chains as well. As part of our cross-chain strategy, we will be working to ensure each of our core features has seamless cross chain interoperability, so whether you’re on BSC or another network, everything will work exactly the same.

The Landshare DAO has received several feature requests, and we want to create a streamlined way for LAND Holders to have a direct impact on the development roadmap. Starting at the end of Q1, the development team will assemble all feature requests from the DAO, as well as other ideas from the team or community, and create a single proposal which allows the community to vote for their top priorities.

Unlike a simple Yes/No proposal, the Quarterly DAO Vote will allow you to distribute your voting power across multiple options, based on how important you feel they are. The development team will then assess the results and use them to prioritize development resources, with the top vote-getters receiving special attention. This is a way for the community to provide direct feedback on our development roadmap and request new features for the platform, and a way for the development team to deliver on the community’s top concerns in a timely manner.

Last but not least, our 4th Core Priority is all about expanding and diversifying the real estate offerings for RWA Token holders. By expanding our selection, we not only reduce risk through diversification but also appeal to a wider range of potential investors.

To this point, we’ve focused on single family rentals and house flips. While we do intend to continue investing in these areas, we will be exploring several new options as well. By expanding our selection, we not only reduce risk through diversification but also appeal to a wider range of potential investors.

Some examples we’re exploring include short-term rentals, multi-unit properties, and mixed-use properties. The new RWA Token model also gives us the flexibility to try different strategies, including fix and hold projects or appreciation plays. Each type of investment comes with its own pros and cons, so we’ll continue to assess the market to find the best fit for our investors.

As the RWA narrative captivates the crypto landscape, our sights are set on a new year marked by extraordinary growth. This roadmap serves as a launchpad for what lies ahead, and we invite you to join us at our Community Town Hall on December 29th at 12 PM CST, and be sure to submit your questions here. Your insights will help shape the future, so let’s unite and propel Landshare to new heights in 2024 — our biggest year yet!

Follow Landshare:

Twitter | Medium | Youtube | Telegram | Telegram Announcements | Coinmarketcap | Zealy

By

Landshare Team

The RWA Token is a brand-new real estate token coming soon to the Landshare ecosystem. Backed by a variety of yield generating real estate assets, the RWA Token streamlines and simplifies investment for all types of users! With easy entry, healthy liquidity, and additional utilities, the RWA Token embodies what real estate on the blockchain should look like.

In this article, we will take a closer look at the tokenomics, utilities, and inner workings of this new system. If you’re new to Landshare or would like to learn more about the RWA Token as whole, please read our Feature Preview article for all of the details.

Upon launch of the RWA Token update, the Landshare ecosystem will feature two different tokens: the Landshare Token (LAND) and the Landshare RWA Token (LSRWA). Each token serves a different role in the ecosystem.

The LAND Token is the platform governance and utility token, serving as a means of exchange, voting, payment, and access. The RWA Token, on the other hand, is a real estate backed security token that represents the value of RWAs. They are separate but equally important components of Landshare.

In the coming sections, we will be covering the unique utilities of the Landshare RWA Token. To learn more about the platform utility token, LAND, please click here.

Each RWA Token represents a share of a pool of US-based real estate assets. This is made possible through tokenization, which is the process of converting real world assets (RWAs) into tokens on the blockchain. The value of each RWA Token grows proportionally with the value of underlying properties and the cash flow they produce, allowing investors to benefit by simply holding over time.

Unlike other cryptocurrencies, the RWA Token represents a legally binding share in the property holding company. This means that as an RWA holder, you are entitled to the same legal protections as an investor in a traditional company. This makes the RWA Token a simple and secure way to gain exposure to real estate directly on-chain.

Our goal with the RWA Token is to leverage the unique advantages of being an on-chain asset. This includes the ability to trade instantly and automatically with decentralized exchanges (DEXes), and to leverage your investment utilizing other systems, including borrow/lend protocols. In this way, the RWA Token is designed to work like any other DeFi asset.

The existing NFT ecosystem will transition from our existing Asset Token to the new RWA Token. Landshare NFTs allow you to stake RWA Tokens and earn LAND rewards by upgrading and maintaining your virtual property. These rewards stack with what you already earn from the RWAs themselves and are a great way to boost your returns. For more information on the NFT ecosystem, see here.

The Landshare RWA Token offers something for every crypto trader, even if they aren’t interested in real estate investment. Unlike USD stablecoins, the Landshare RWA Token is transparently backed 1:1 by RWAs and can grow in value over time. The asset-backed nature of RWA Tokens means they are not subject to the wild swings commonly seen in the crypto space. In this way, RWA Tokens offer an excellent safe haven for crypto investors.

The RWA Token is designed to maintain a relative peg with the underlying real estate assets it represents. Each RWA Token represents a share of the pool of underlying properties, which also includes the rental income they produce. A simple calculation is used to determine the value of each RWA Token:

RWA Token Value = (Total Property Value + Total Cash Reserves) / Circulating RWA Token Supply

The RWA Token can be bought or sold on the Landshare platform for its underlying value based on the calculation above. This ensures adherence to the value of underlying assets and price stability in secondary markets such as DEX trading.

Now that we understand how the RWA Token’s value is determined, let’s break down each component of the calculation.

The value of properties is estimated using Corelogic AVM, which utilizes real estate information such as comparable sales, property characteristics, and price trends to provide a current estimate of market value for a specific property. Corelogic AVM is widely used in the real estate industry to estimate the value of properties, including by clients like Realtor.com.

The estimated values of each property are added together and automatically brought on-chain via Chainlink Any API and Chainlink Automation. This allows our smart contracts to store the latest price of the properties at all times.

In addition to property values, the RWA Token will benefit from the rental income generated by properties. Cash reserves may include USD in a bank account or stablecoins on-chain. Similar to property values, every time the cash reserves change, the updated total will be stored on-chain.

Combining total cash reserves and total property value determines the total underlying RWA in the pool, so the final step of the calculation is to determine the value of each individual token.

The circulating RWA supply will include all tokens sold to investors. This total does not include unsold tokens from the offering. As tokens are sold from the offering, circulating supply will increase. Meanwhile, the proceeds enter the cash reserves, maintaining equilibrium as supply expands. In some cases, circulating supply may be reduced through redemption events.

A real estate-backed token should look and feel just like any other token on the blockchain. We’ve designed the RWA Token with that in mind — focusing on ease of use, DeFi integration, healthy liquidity, and additional utilities.

The RWA Token will also boost the utility of our existing LAND utility token. Each token serves a complimentary function in the Landshare ecosystem, and both are equally crucial to the functioning of our platform. To read more about the interaction between LAND and the RWA Token, check out our previous Development Update.

We expect to determine a launch window very soon. In the meantime, you can look forward to upcoming events and campaigns to help get the word out about the RWA Token! If you haven’t already, be sure to check out our Feature Preview article for more information on the RWA Token.

Find us on:

Twitter | Medium | Youtube | Telegram | Telegram Announcements | Coinmarketcap

By

Landshare Team

Last Thursday, our CEO Jordan Friske sat down with Justin Banon from Boson Protocol for a thoughtful AMA session about both projects as well as the past, present, and future of RWAs. The full recording of the space is available to listen to here.

If you’re unable to catch the full AMA, don’t worry — we’ve got you covered! In this article, we’ll summarize some of the biggest takeaways for the Landshare community from the session, including our strategy for healthier liquidity, multichain, the RWA Token launch window, and a look ahead to some of our plans for 2024.

Let’s dive in!

Liquidity is a top priority for the RWA Token update, since it’s one of the biggest drawbacks to traditional real estate investment. During the AMA, Jordan highlighted our desire to provide a truly liquid form of real estate investment, where investors can buy and sell for the full value of the underlying assets.

This goal has proven difficult to achieve, with many real estate projects acting as centralized market makers, creating illiquid DEX pools, or relying on entirely off-chain solutions.

To address the problem at its core, we’ve adopted a 3-pronged strategy:

You can read more about the liquidity model for the RWA Token here.

Multichain is another highly discussed topic, and one of our top priorities as we move forward into next year. Throughout the session, Jordan emphasized the importance of integrating RWA Tokens to leverage DeFi capabilities currently applied to traditional tokens. This involves utilizing decentralized exchanges, lending protocols, and the necessity for multichain capabilities to actualize this vision.

Furthermore, the implementation of multichain capabilities enhances our ability to engage with new users, as part of our broader strategy to amplify the visibility, exposure, and accessibility of Landshare.

When considering new chains to expand into, the following criteria are considered primarily important:

Based on these criteria, in addition to community feedback, we are eyeing Polygon as the first cross-chain network for Landshare.

The RWA Token launch is the essential first step towards realizing the objectives we’ve outlined during the AMA session and in our previous updates — DeFi integrations, healthy liquidity, and efficient scaling. With the RWA Token also comes improvements to every other aspect of the ecosystem, including new LAND Token utilities, a refreshed UI/UX, additional quality of life features, and much more.

After months of work, we are wrapping up the integrations and campaigns we’ve prepared for this update and are on track for a Q4 launch. The community can expect more details on the rollout of this new feature, including the migration timeline for existing Asset Token and NFT holders, followed by a full update launch. In the meantime, be sure to check out our Feature Preview article for a deep dive on our most ambitious update yet!

To wrap up the AMA, Jordan provided some insights into the project’s future plans. We are still finalizing the roadmap for 2024 and plan to put out a detailed post toward the end of the year. In the meantime, a few of our priorities were provided during the session:

With the new feature launch, there is no better time to start expanding the visibility and access to the Landshare ecosystem! These are just a few of the avenues the team is exploring:

In terms of property development, we have two main goals: expansion and diversification.

To this point, the focus has been on single family rentals and house flips. In addition to a brand-new property debuting with the RWA Token, the team is currently assessing new types of property investments, including short term rentals like Airbnbs and multi-unit properties.

Although the RWA Token update is comprehensive, our work doesn’t stop when it goes live! We will continue to improve on our existing features, including by adding the LAND Holder tracker recently proposed by the DAO. We’ll also be focused on further streamlining the RWA investment process, including by adding the option for credit/debit card payments. And of course, we’ll be adding new features and integrations to improve the utility of both LAND and the RWA Token.

These are just a few of our priorities — you can expect a much more comprehensive update toward the end of the year!

Twitter | Medium | Youtube | Telegram | Telegram Announcements | Coinmarketcap | Zealy

Telegram | Boson Protocol Twitter | Portal Twitter | LinkedIn | Website | YouTube | Discord

By

Landshare Team

The Landshare Token (LAND) is the native utility and governance token for Landshare. LAND sits at the heart of all platform features, serving as means of payment, access, voting, and more. It comprises one of the two tokens available to users, along with the upcoming RWA Token.

With two different tokens available, it’s vital to understand the role LAND plays in the platform and how it synergizes with the RWA Token to create a complete ecosystem. In this article, we will briefly compare LAND and the RWA Token, review a comprehensive list of LAND utilities, and take a fresh look at LAND’s current tokenomics.

The Landshare platform features two different tokens — the Landshare Token (LAND) and the RWA Token (LSRWA). Although both tokens are integral parts of the ecosystem, they each serve their own unique purpose.

LAND is a traditional utility and governance token, similar to those available on many crypto platforms. It serves various roles throughout the entire platform and is used to access our signature features, including RWA investment, NFTs, staking, and the Landshare DAO. In short, LAND is the key to the entire Landshare platform!

LAND is an excellent choice for crypto-centric users looking for a traditional utility token. It is currently available for trade on Pancakeswap and Gate.io.

The RWA Token is a security token that enables real estate investment on Landshare. Unlike LAND, the RWA Token requires KYC to purchase.

Each RWA Token represents a share of a pool of US-based real estate assets. The value of each RWA Token grows proportionally with the value of underlying properties and the cash flow they produce, allowing investors to benefit by simply holding over time.

The RWA Token is an excellent choice for users looking to invest directly into real estate on the blockchain. To learn more about the RWA Token, check out our previous article Landshare RWA Token: Utilities and Tokenomics.

The LAND Token plays an essential role in all platform features, including vaults, governance, NFTs, and RWA offerings. This list covers the utilities up to and including the RWA Token update, but will continue to expand as new features are added to the platform.

The LAND Token represents voting power in the Landshare DAO, which is the primary governance mechanism for the platform. The DAO and its voters have direct control over key elements of the platform including:

Through the DAO, the future of the platform lies in the hands of LAND holders! For more details on governance mechanics, check out our docs page.

Landshare Real Estate NFTs are stylized 3D NFT models of the real-world assets offered on Landshare’s platform. NFTs enable RWA Token holders to earn additional yields through a unique gamified staking system.

The NFT ecosystem utilizes the LAND Token in a number of critical ways:

Investment in real-world assets is made possible through the RWA Token. However, the LAND Token plays an integral role in the process of acquiring and trading RWAs on Landshare.

In order to purchase RWA Tokens, you must make your payment in 90% stablecoins and 10% LAND tokens, pursuant to the total USD value of the purchase. For example, if you wish to purchase $1,000 in RWA Tokens, the total purchase price would be $900 in stablecoins and $100 in LAND Tokens.

With the new fixed-price liquidity pool, RWA Tokens can also be sold on demand based on the underlying asset value. When initiating these sales, a 1% LAND fee will apply. For example, a sale of $1,000 in RWA Tokens will incur a $10 LAND Token fee.

While LAND has many uses across the ecosystem, there is also an incentive for simply holding the token or providing liquidity — staking! There are 3 different ways to earn additional rewards from your Landshare Tokens through our vaults page:

The Landshare Token has an elastic supply, with an adjustable minting rate and dynamic burning mechanics that can affect the total number of tokens over time. However, one thing remains unchanged—LAND has a hard minting cap of 10,000,000 tokens, with each burn counting against that number permanently. Here is a basic rundown of supply at the time of writing:

A vesting schedule applied to the first year of launch and can be viewed in the Whitepaper. However, all vested tokens have since been released into circulating supply. With the exception of the DAO Treasury reserve and burnt tokens, all minted tokens are in active circulation. The remaining un-minted tokens will be distributed over time as staking rewards (97.5%) and to the DAO treasury (2.5%).

The LAND Token has a number of mechanisms designed to remove tokens from supply. Because the mint rate is capped at 10,000,000 tokens, each burn effectively reduces the supply cap of LAND permanently. Some examples of burn mechanisms are:

Landshare is about closing the gap between real estate and DeFi — and we achieve this through our two tokens, LAND and RWA. Each token serves a complimentary function in the Landshare ecosystem, and both are equally crucial to its success.

To learn more about the LAND Token and the platform features covered in this article, be sure to check out our collection of useful resources:

LAND can be purchased on Pancakeswap or Gate.io.

Find Landshare On:

Twitter | Medium | Youtube | Telegram | Telegram Announcements | Coinmarketcap | Zealy

By

Landshare Team

Tokenization, the process of converting real-world assets (RWAs) into digital tokens, has gained significant momentum in both traditional finance and the blockchain space. Although a relatively new concept, it’s already starting to disrupt major traditional markets, including real estate, commodities, and even art.

According to a report by Deloitte, the global market for tokenization is expected to reach $544 billion by 2025, with Boston Consulting Group projecting a surge to $16 trillion by 2030. The numbers don’t lie — the rise of RWA tokenization is here, and this is only the beginning.

In this article, we will provide an overview of the past, present, and future of RWA tokenization, and its implications for both traditional finance and the future of the blockchain space.

RWA tokenization is a process where the ownership rights of a real-world asset, such as a rental property, are represented as digital tokens on a blockchain. The tokens become digital representations of ownership, usually in the form of shares in a legal entity that holds the RWA(s). In this way, the tokens take the place of traditional methods of tracking ownership, such as stock certificates or membership ledgers.

Tokenization can be used to fractionalize illiquid assets such as real estate, or simply to allow for real-world assets to be represented digitally. In short, it’s a method to create fractional units of any asset — physical or digital — and trade them on a blockchain.

The idea of asset tokenization can be traced back to the creation of Bitcoin, the world’s first cryptocurrency. Bitcoin was created in 2009 and introduced the concept of the blockchain, a distributed ledger technology which allows for secure and transparent transactions without the need for intermediaries.

While Bitcoin first introduced the blockchain to the world, the industry took a major step forward with the launch of smart contracts on Ethereum. Smart contracts are programs that can be deployed to a blockchain, enabling the execution of complex business logic on-chain. It quickly became clear that this technology could be used to digitize and fractionalize real world assets, creating an entirely new financial ecosystem.

With the technology in place, a clear legal framework was still required to truly facilitate tokenized ownership. In 2017, the US state of Delaware amended its General Corporation Law to account for the use of blockchain technology in corporate record-keeping, enabling the issuance of company shares as digital tokens. This landmark legislation established a legal basis for tokenized ownership of RWAs, marking a major victory for proponents of blockchain technology. Since then, several jurisdictions and regulatory bodies have made strides in acknowledging and providing legal support for tokenized RWAs.

The early growth of tokenization has been nothing short of impressive, particularly in real estate. Investment in tokenized real estate has nearly tripled in the last year, making it the fastest growing security token sector. The adoption of tokenization in real estate is motivated primarily by the desire to provide liquidity to traditionally illiquid assets, enabling investors to gain exposure to the asset class without the requiring large amounts of capital.

Tokenization has also seen significant growth in the art world. According to a report by Art Basel and UBS, the global art market was valued at $67.4 billion in 2018. However, the market has traditionally been dominated by wealthy individuals, making it difficult for smaller investors to gain exposure. Tokenization solves this by allowing for the fractionalization of artwork, enabling modest investments in high value pieces.

Another growing use of tokenization is US Treasury Bills. According to a recent report from Coindesk, the total volume of tokenized T-Bills has reached over $600 million. This growth can be attributed to the difficulty for non-US investors to access this lucrative market, widely regarded as one of the safest investments in the world. Tokenization breaks down these international barriers by enabling seamless investment with stablecoins or other cryptocurrencies.

In total, the tokenized RWA market has ballooned to over $2.3 billion in a few short years. While this is impressive, projections for the total value of tokenized RWAs in 2030 range anywhere from $4 trillion all the way up to $16 trillion, a minimum 4-fold increase over the current market cap of all cryptocurrencies combined.

While traditional finance and cryptocurrency are separate industries, many believe tokenization will play a key role in the future of both of them. In fact, tokenization may very well represent the bridge between the two industries, tying them together in a way that is mutually beneficial.

Cryptocurrencies are known to be highly volatile, with abrupt price movements and unpredictable market cycles becoming the norm. As the industry becomes more sophisticated, there is an increasing demand for products that provide reliable yields and access to traditional markets. Through tokenization, RWAs can be traded interchangeably with Bitcoin, stablecoins, and all other crypto assets, introducing an additional layer of value to the ecosystem.

Traditional finance, on the other hand, has long struggled to drag its infrastructure into the digital age. The global financial system is a series of disjointed and often archaic systems that present massive barriers to international investment. The blockchain, a borderless and decentralized financial network, offers a compelling solution to these longstanding challenges.

By integrating tokenization, financial systems across the world can be streamlined and modernized, particularly in cross-border transactions. The need for cumbersome systems like international bank wires and currency conversions can be eliminated entirely, replaced by instantaneous settlement and automated transactions through smart contracts.

The meteoric rise of RWA tokenization has the potential to disrupt not only the cryptocurrency space, but also the global financial system as a whole. The blockchain is the financial infrastructure for the digital age, facilitating cross-border exchanges, instantaneous settlement, and trustless operations, and those in traditional finance are starting to take notice.

Cryptocurrency and finance are often view separately from one another, but RWA tokenization is the bridge between them — and may very well represent the future of both.

Twitter | Medium | Youtube | Telegram | Telegram Announcements | Coinmarketcap | Zealy

By

Landshare Team

As the world continues to transition into the digital age, financial institutions are seeking new ways to transform legacy infrastructure into modern, global, and digitally native systems. One of the most promising developments on this front is the use of tokenization.

Tokenization involves the representation of traditional assets such as real estate, art, and stocks as digital tokens on a blockchain network. Tokenization can bring about several benefits, including increased liquidity, fractional ownership, and increased accessibility to investors. It breaks down geographic barriers presented by existing financial systems and enables seamless global exchange of assets.

As time goes on, more and more banks, financial institutions, and even governments are exploring tokenization as a solution to real world problems. In this article, we will highlight seven major institutions who have embraced this emerging technology.