Landshare Team

.png)

Inflation is an economic phenomenon that shows the rate of increase in prices over some time. Typically, inflation is a broad measure, including the overall price increase or the cost of living in a country. It affects the purchasing power and could be severe across countries. In general, inflation is considered to eat away savings over time and, in most cases, even the profits of your investments.

Since inflation could be fatal enough to diminish your profits, picking and choosing the assets that can give it a tough battle becomes crucial. And bear in mind that it should also beat it. In the long history of investments, real estate investments have proven their worth regardless of how bad the odds were. Experts have always believed that real estate is a hedge against inflation. An advent of tokenized real estate is also taking place in mainstream discussions.

In today's fluctuating economic landscape, safeguarding your investment portfolio against inflation is more crucial than ever. As inflation erodes purchasing power and diminishes the actual value of money, experts frequently turn to real estate as a robust shield against these forces. This blog delves into why real estate is a bulwark against inflation, particularly its tokenized form.

The increase in prices of commodities, assets, or anything that can be purchased is inflation. The purchasing power of a currency decreases due to increasing inflation. For instance, consider the inflation rate in the United States at 3%. If you buy a toothbrush for $20 today, you would buy it for $20.6 the next year and $21.2 the following year.

What should a 60 cents or $1.2 increase affect? The difference may not seem significant, but inflation is a burning issue since it burns purchasing power and, ideally, sitting savings.

There are multiple factors to measure inflation in any given region or country. In the United States, there's the Consumer Price Index (CPI) that measures inflation. To gauge inflation, changes in commodity prices are tracked, and how much a customer pays for a basket of certain consumer goods is observed. Not all products or commodities see a price increase; some get cheaper, too. The mean cost of all the commodities brought us the inflation rate.

Inflation affects investments in general to a large extent. Since the purchasing power decreases with soaring inflation, people prefer to pay for the basic requirements at present over making investments to generate profits in the foreseeable future. Now that the investments are less, the profit is even smaller, triggering a vicious cycle.

According to Goldman Sachs, "inflation can be a friend to real estate." This is true because the construction cost rises with increasing inflation, resulting in the appreciation of property prices. 2023 was uncertain where the world was moving towards inflation while the governments across countries worked to curb the rising prices, and a looming recession was on the other side.

Macroeconomics evolved frequently during those times, and it became necessary for investors to keep their portfolios stable with some stable investment vehicle, such as real estate. Historically, the real estate market has proven its worth when weathering softer economic situations.

The real estate market mostly runs ahead of inflation or at least follows it to a large extent, depending on the region. Construction cost is among the reasons behind appreciation in the real estate market. At the same time, demand and supply are crucial factors in deciding the price, as they do for every other product or service in the market.

Within the diverse array of investment options available today, including stocks, physical gold, gold ETFs, commodities, and floating-rate bonds, each presents its own set of advantages and drawbacks when it comes to hedging against inflation. However, real estate stands out as a historically reliable safeguard against inflation.

Global data since 1980 shows that commercial real estate has surpassed other investment classes in six out of seven inflationary cycles, showcasing its resilience in preserving value and performance amidst inflationary pressures. Inflation leads to a significant rise in the costs associated with constructing new properties, elevating the importance and value of existing properties. This scenario enhances the potential for increased rental income and improved liquidity from a real estate investment standpoint.

Now that you are convinced that real estate investments win over inflation, let’s talk about the changing landscape of real estate investments. The industry is witnessing a paradigm shift due to technological advancements. Tokenization is the process of bringing tangible real world assets (RWA) to blockchain technology. These assets include tangible financial investments such as commodities, currencies, and real estate.

The real estate sector is moving towards tokenization with higher speed. The market size of tokenized assets can hit $10 Trillion by 2030, whereas the real estate tokenization market could swell to over $18 Billion by the end of this decade. Tokenized real estate investments make traditional investment methods better and more efficient. Entering the real estate sector becomes less complicated, needs less or no paperwork, and comes with better transparency and liquidity.

A huge number of projects emerged in the past few years, such as Landshare, Centrifuge, Maple, Pendle, and several others. These projects are involved in tokenization of RWAs.

Tokenized real estate brings more advantages than existing benefits of real estate investments. Tokenization of real estate makes fractional ownership of property possible. It lowers the threshold, making it feasible for many investors to foray into the real estate landscape. The investor base increases significantly, and more investors bring more liquidity.

Landshare is highly active in the tokenized real estate sector selling three properties on the Binance Smart Chain (BSC). The native Landshare RWA (LSRWA) token facilitates a pool of properties for users to invest in real estate. Other similar projects are holding the baton of tokenized real estate and making a mark.

Real estate's tangible nature and the advent of tokenization have solidified its position as an unbeatable hedge against inflation. By offering tangible assets that appreciate over time, coupled with the innovative tokenization approach, real estate stands as a fortress for investors seeking to protect their portfolios from inflation's erosive effects.

As we move forward, the fusion of traditional real estate investment with blockchain technology promises to redefine the landscape of inflation-resistant investments. Tokenized real estate, with its unique blend of accessibility, efficiency, and scalability, is at the forefront of this evolution. It offers a promising avenue for investors aiming to weather the storm of inflation.

Landshare Team

The advent of blockchain technology heralds a seismic shift in the real estate sector, promising unparalleled liquidity and accessibility through tokenizing real-world assets (RWAs). Traditionally we have seen the real estate sector as an illiquid asset class with high entry barriers but now it is reimagined by integrating on-chain secondary market trading of RWA tokens.

According to CoinMarketCap, the market cap of real-world asset (RWA) tokens stands above $53.7 Billion. This substantial market cap shows us that the RWA sector in the crypto market is proliferating. The high pace of growth ensures that it will soon overlay a notable portion of the traditional real estate market.

We can see how the RWA narrative has taken crypto space by the storm, and it has made a massive leap in the financial landscape. It is making tangible financial assets such as real estate investments more fluid, transparent, and accessible to a broader spectrum of investors. The amalgamation of RWA tokens with secondary market trading brings unprecedented advantages for you in the highly lucrative real estate investment sector.

We can understand secondary market trading as trading of assets among buyers and sellers rather than with the companies or projects. A budding project in the crypto space launches a token through either an ICO, IEO, or IDO, which primarily trades native tokens in exchange of raising funds from investors. After the launch, when these tokens are up for trade among traders, it becomes a secondary market, and the trading becomes secondary market trading.

NYSE and NASDAQ are, for instance, secondary market trading platforms, as they offer you to trade or invest in stocks. On the same note, trading on both centralized and decentralized crypto exchanges falls within secondary market trading. We can trade Bitcoin on crypto exchanges such as Coinbase or buy or sell Ethereum on decentralized exchanges like Uniswap.

Real-world assets (RWAs) refer to objects possessing tangible or intangible value, including but not limited to gold, fine art, and real estate. In 2024, the scope of these assets linked to the real world is set to broaden beyond the confines of physical space. The advancement of blockchain technology makes the expansion possessive, providing a unique on-chain identity to traditional assets. This innovation creates a novel concept known as the real-world asset token.

The global real estate market is over $630 Trillion today and is continually growing. It is expected to hit $729 Trillion by 2028. This also makes real estate investments one of the most lucrative investment vehicles due to huge returns, but they do come with their own shares of hassle.

The real estate market is illiquid, and even a single transaction of buying or selling a property could take weeks or even months. In addition, it takes time to complete the extensive paperwork required for a transaction, making the whole process inefficient.

With the introduction of real estate-backed RWA tokens, real estate property transactions can now be carried out faster, more transparently, and more efficiently. There's more to the phenomenon than just that; let's delve into the benefits of trading RWA tokens in secondary markets.

As mentioned above, the RWA crypto tokens already have a market cap of billions of dollars. Several projects are spearheading change within the space with unique propositions and offerings.

Landshare ($LAND) is among the rare projects that offer real estate-backed RWA tokens: Landshare RWA ($LSRWA). $LAND is the native utility and governance token that takes care of transactions and other operations over the platform.

The RWA token represents the unit of the pool of real estate properties 1:1. Landshare makes it possible for you to step into tokenized real estate investments with as low as $1. Landshare RWA tokens are playing a crucial role in changing the real estate investment landscape with unique propositions and offerings.

Landshare is actively tackling the challenge of the lack of secondary trading options for most security tokens with a comprehensive three-pronged approach. The strategy includes on-chain valuations, ensuring transparency with up-to-date property valuations and cash reserves; fixed price liquidity, maintaining token value alignment with the underlying assets through controlled sales; and DEX Trading, aiming to foster a vibrant secondary market for LSRWA tokens by enabling unrestricted trading.

The upcoming listing of LSRWA Tokens on the DS Swap Security Token DEX is a significant milestone in this endeavor for Landshare. The on-chain real estate trading by offering instant settlements, no transaction fees, and the flexibility to trade against LAND or stablecoin pairs will be possible and it's a paradigm shift in making.

The introduction of the DS Swap listing is expected to amplify trading dynamics by providing zero-fee liquidity pools, facilitating arbitrage opportunities, and allowing for higher trading limits. Landshare takes a leap in resolving the liquidity issues with the DS Swap Security Token DEX listing, promising a more fluid and accessible market for real estate tokenization.

Further enriching the ecosystem, Landshare plans to propose an LSRWA-USD liquidity pool, akin to the successful LAND-BNB LP, to incentivize LSRWA holders with rewards for contributing to liquidity. This initiative not only aims to elevate LSRWA's utility but also to broaden the trader base, mitigate price volatility, and ensure a more stable and liquid market environment.

The Path Forward: Innovation and Opportunities

The tokenization of real estate assets paves the way for innovative investment models and financing mechanisms, from crowdfunded investments to yield-generating real estate funds. These developments promise to enrich the investment landscape and provide property owners and developers with novel avenues for funding and growth.

The listing of LSRWA Tokens on the DS Swap Security Token DEX represents a pivotal moment for Landshare, a huge change in on-chain real estate trading. Enabling instant settlements, zero transaction fees, and versatile trading against LAND or stablecoin pairs, this step will bring unprecedented liquidity in the space. It amplifies trading dynamics with zero-fee liquidity pools, arbitrage opportunities, and higher trading limits, marking a significant step towards solving liquidity issues and enhancing the accessibility of real estate tokenization.

RWA tokens' on-chain secondary market trading sets the stage for a more liquid, inclusive, and dynamic real estate market. By leveraging the power of blockchain technology, the real estate sector is poised for a transformation that promises to redefine the essence of property investment, making it more accessible, efficient, and attractive to a global audience of investors.

The future of real estate investment is not just about owning property; it's about being part of a revolutionary movement toward a more democratized financial ecosystem.

Landshare Team

The world is moving fast and every now and then we see disruption in traditional industries by emerging technologies. Blockchain is undoubtedly a state-of-the-art technology which is changing the landscape across the industries. It keeps changing the fundamental operations and bringing better and efficient solutions. Tokenization of Real World Assets (RWAs) is possible due to blockchain technology and is on the way to becoming a trillion dollar industry.

The RWAs could include a wide range of assets from the tangible financial or traditional physical world including real estate, commodities, artifacts, or even the digital tokens, the list goes on for real world assets. Although we are witnessing that the tokenization sector is on boom and spreading across different sectors, it is making a notable difference in real estate. A significant number of projects have surfaced in recent years that focus on tokenization of the real estate sector.

Industry experts have recognized tokenization as an enterprise blockchain solution with huge potential in the future. Co-founder of crypto exchange Coinbase Fred Ehsram quotes that “Everything will be tokenized and connected by a blockchain one day.”

Tokenization is a process of representing the value of real world assets on blockchain. When an asset is represented as a digital token that can be exchanged and kept on a blockchain, this process is known as tokenization. We do not need middlemen, while secure and transparent record-keeping is made possible by distributed ledger technology, or blockchain.

Real World Assets (RWAs) includes tangible assets such as real estate properties and art pieces, financial instruments such as commodities, bonds, and equities and intangible assets intellectual property, data and identity.

Data suggests that RWA tokenization emerged as a fast-paced segment across the DeFi space. According to DefiLlama, in December 2023, the RWA tokenization was sitting on total value locked (TVL) of around $5 Billion.

Increased liquidity, fractional ownership, and easier transferability are just a few advantages that blockchain-based tokenization offers over conventional asset ownership and trade. Tokenized assets can be exchanged anywhere in the world, at any time, and without middlemen, which lowers expenses and expands the pool of possible investments.

Though tokenization is a typical procedure with technological aspects, still here we try to give a simple explanation. The tokenization process begins with determining the best method to digitize the chosen asset, which varies based on the asset's nature, such as a money market fund versus a carbon credit, and its classification as either a security or a commodity under relevant laws.

Next, if the asset has a tangible form, it is secured in a mutually agreed-upon location. Following this, a token representing the asset is created on a blockchain, with necessary compliance measures in place. This digital asset is then ready for distribution, requiring investors to use a digital wallet for storage and possibly trade on a secondary market with less stringent regulations.

Post-distribution, the asset undergoes continuous management, including compliance with legal and financial reporting, to ensure its integrity and value are maintained.

RWA Tokenization is taking the world by storm and there are a number of reasons behind it in the form of benefits and offerings. It solves many inherent issues across the sectors along with bringing new age solutions. The solutions not only saves cost and efforts but end up making the traditional procedure more efficient and easy. Let’s talk about the advantages of RWA tokenization in depth.

Accelerated Settlements Through Constant Availability: Traditional financial settlements typically take up to few business days to complete, allowing time for all parties to prepare necessary documents and funds. Tokenization enables immediate settlements, offering potential savings, especially in environments with high interest rates, by facilitating round-the-clock transactions.

Reduction in Operational Expenses with Programmable Assets: Tokenization brings significant cost reductions in asset management, particularly for assets that traditionally require extensive manual intervention, like corporate bonds. By integrating functions such as interest computation and payment distributions into a token’s smart contract, these processes become automated, minimizing the need for manual oversight.

Opening Investment Opportunities to a Wider Audience: The efficiency gained from automating complex and labor-intensive processes makes it financially viable to serve a broader range of investors, including those with smaller capital. However, for this democratization to fully materialize, the distribution of tokenized assets must expand substantially.

Boosted Transparency Through Smart Contracts: The deployment of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, enhances the transparency of transactions. For instance, in the case of tokenized carbon credits, the blockchain can maintain a clear, unchangeable record of the credits' ownership and transactions.

More Flexible and Cost-effective Infrastructure: Leveraging blockchain technology, which is open source by nature, results in a more adaptable and less expensive infrastructure compared to traditional financial systems. This aspect of blockchain facilitates quicker adjustments to meet evolving regulations or operational demands.

The landscape of RWA tokenization, or digitizing tangible assets through blockchain, is at a foundational stage with a promising outlook. As the underlying blockchain technology evolves and legal frameworks become more defined, this area is poised for notable expansion. RWA tokenization issuance is forecasted to reach $4 to $5 trillion by 2030.

Here's a snapshot of emerging trends in the realm of RWA tokenization:

Wider Acceptance: Anticipate a surge in the embrace of this innovation across diverse industries. Companies leveraging this approach stand to gain by making assets more liquid, slashing operational expenses, and widening the pool of potential investors.

Legal Frameworks Gaining Shape: The growth trajectory of RWA tokenization hinges on clear legal guidelines. Authorities are progressively understanding the value of these digital assets and are crafting laws to safeguard investors while promoting creative advancements.

Cross-Platform Exchangeability: The fluid exchange of tokenized assets among various blockchains and platforms is essential for the sector's vitality. Efforts are underway to establish norms and protocols that enable such seamless transfers, aiming to boost market liquidity and effectiveness.

Security Enhancements: With the rise in the value of digital assets, enforcing stringent security protocols is becoming increasingly crucial. Cutting-edge solutions, including decentralized verification and layered authentication measures, are being developed to fortify the safety of these assets.

DeFi Convergence: The intersection of RWA tokenization with the burgeoning sector of DeFi heralds the creation of innovative financial mechanisms. This amalgamation is set to offer unprecedented opportunities for decentralized financial activities, from lending and borrowing to generating passive income.

These evolving dynamics suggest a transformative phase for the tokenization of real assets, promising to redefine the contours of asset management and investment through increased accessibility, security, and market fluidity.

There are a number of industries that saw a significant interest in tokenization of assets. The real estate sector has swiftly acknowledged the advantages offered by tokenizing. Transforming tangible real estate into digital tokens enhances trading efficiency and liquidity. This innovation provides investors with fresh opportunities, reduces entry obstacles, and enables partial ownership of premium properties.

In addition to real estate, tokenization is transforming investment in art, collectibles, private equity, commodities, and venture capital. It democratizes access to high-value art and collectibles by allowing fractional ownership through digital tokens, enhancing portfolio diversification.

In private equity, it streamlines capital raising and increases asset liquidity, making it easier for investors to trade shares in private companies. For commodities like gold and oil, tokenization offers a simplified trading mechanism, bypassing the need for physical handling. In venture capital, tokenizing startup equity facilitates capital raising and provides early-stage investors with liquidity, allowing them to realize returns without waiting for traditional exit events.

Avalanche is emerging as a key player in the RWA tokenization space, attracting major banks like JP Morgan, Citi, and Bank of America. These institutions are leveraging Avalanche's technology and Subnets to develop blockchain solutions for tokenizing funds, facilitating forex trades, and exploring broader asset tokenization opportunities.

Chainlink plays a crucial role in the tokenization of real-world assets, offering transparency, cost-effectiveness, and accessibility in financial transactions. Research by K33 highlights Chainlink's LINK as a secure choice for investors interested in RWAs' tokenization. Chainlink's platform enables the enrichment of RWAs with real-world data, secure cross-chain transfers, and connection to off-chain data, making it a key player in this emerging landscape.

The real estate sector market is one of the fastest growing industries worldwide. Statista report states that in 2021, the global real estate market size stood at $585 Trillion. It is expected to be a staggering $729.4 Trillion in 2028 with a CAGR of 3.4%.

Given the sheer size of the industry, tokenization of real estate has a huge potential in the near future. There are several projects already active in the space leading the way for the industry. We at Landshare intend to unlock the vast prospect of real estate for the masses.

Landshare stands out in the real estate tokenization sphere through its innovative and reliable unique selling points. Our ability to successfully sell three properties via the Binance Smart Chain (BSC) highlights our operational proficiency and the market's endorsement of our approach.

The introduction of our Real World Asset (RWA) token, Landshare RWA ($LSRWA), opens up new opportunities for investors aiming for diversification and passive income. This token allows investors to access a selection of properties. Our platform's functionality and transactions are significantly supported by our native utility token, $LAND.

Beyond the fundamental benefits of tokenized real estate, we offer additional perks that enhance its appeal. Holding $LAND enables us to offer investors returns over 12%, while participating in $LAND-$BNB LP stake can yield rewards as high as 66%. Landshare's commitment to innovation, security, and profitability continues to propel us forward in the tokenized real estate market.

Real estate tokenization transforms property investment and management through several key benefits:

Enhanced Liquidity: Tokenizing real estate allows for the fractional buying and selling of property interests, significantly increasing market liquidity. This process enables smaller investments and makes it easier for owners to sell parts of their assets quickly, offering flexibility previously unseen in the traditional real estate market.

Accessible Fractional Ownership and Diverse Portfolio Opportunities: Democratization of real estate investment becomes possible by lowering entry barriers and enabling portfolio diversification across various properties and locations, thus reducing risk and potentially enhancing returns for a broader investor base.

Participation in Global Real Estate: Tokenization erases geographical boundaries, enabling global investment in local real estate markets. This not only broadens the investor base but also injects foreign capital into markets, potentially stabilizing property values and encouraging economic diversity.

Efficiency, Transparency and Low Transaction Fees: Tokenization enhances transaction efficiency, reduces costs, and speeds up processes by eliminating traditional bottlenecks and paperwork. It ensures transparency, recording every transaction to minimize fraud risks, thereby building investor trust. Additionally, it cuts down on intermediary fees, making investments more accessible and profitable.

Simplified Asset Management: Digital tokens simplify the management of real estate assets, from leasing to maintenance and sales. This efficiency reduces administrative burdens and costs, potentially increasing the profitability of real estate investments.

These advancements collectively represent a significant shift in how real estate is viewed, traded, and managed, offering unprecedented opportunities for investors and transforming the real estate landscape into a more inclusive, efficient, and secure market.

The tokenization of Real World Assets (RWAs) represents a groundbreaking shift in how we view and manage assets across various industries. With its roots deeply entrenched in blockchain technology, tokenization is paving the way for a more efficient, transparent, and accessible market. The real estate sector, in particular, has seen a remarkable transformation through tokenization, offering benefits like increased liquidity, fractional ownership, and global participation. As we look towards the future, the potential for tokenization extends far beyond real estate, touching every corner of the investment world from art and commodities to intellectual property.

Landshare's initiative in real estate tokenization exemplifies the practical application and immense potential of this innovation, demonstrating how traditional barriers can be dismantled to unlock new investment opportunities. With the global real estate market poised for significant growth, the role of tokenization will undoubtedly expand, bringing with it a host of advancements in how we buy, sell, and manage assets. As industry leaders and pioneers continue to explore and invest in tokenization, the landscape of asset management is set for a revolution, making investment more democratic, secure, and efficient for all.

Landshare Team

The financial markets worldwide are witnessing paradigm shifts with inclusion of emerging technologies. Mckinsey report says that the new-age fintech has surged from the periphery to dominate financial services, with its market cap hitting $550 billion by July 2023, and the number of fintech unicorns reaching 272, valued at $936 billion. This growth, driven by innovation, digitization, and changing consumer demands, has seen fintech reshape financial services.

We look at traditional investment sectors such as real estate and commodities markets that are also poised for transformation. One of the technological advancements that emerged recently is tokenization.

The global real estate market is valued in trillions of dollars, yet it's characterized by low liquidity and high entry barriers. Tokenization is poised to unlock the value of illiquid assets and make them accessible to a wider range of investors.

For the real estate market which is worth a whopping $600 Trillion as of now, tokenization is a game changer that can contribute to the sector’s growth and eliminate inefficiencies to a large extent. Several cryptocurrency projects, such as Landshare ($LAND), have also emerged in the past several years dedicated to the tokenization of the real estate sector.

Let’s dive deeper into the subject and try to understand what is on the other side of the innovative intersection of real estate and blockchain technology and how Landshare-like platforms play a crucial role in achieving success.

Tokenization is a process of issuing a digital representation of an asset over a blockchain. The process ensures digital representation of tangible financial assets over blockchain. A tokenized version of a physical asset does not only keep the inherent traits but also eliminate the shortcomings.

The process of tokenization includes token issuance, sale of the token, and then custody of the security token. However, the process of ownership includes asset’s going through tokenization which is then divided into a certain number of tokens where each token represents a percentage of the property possession.

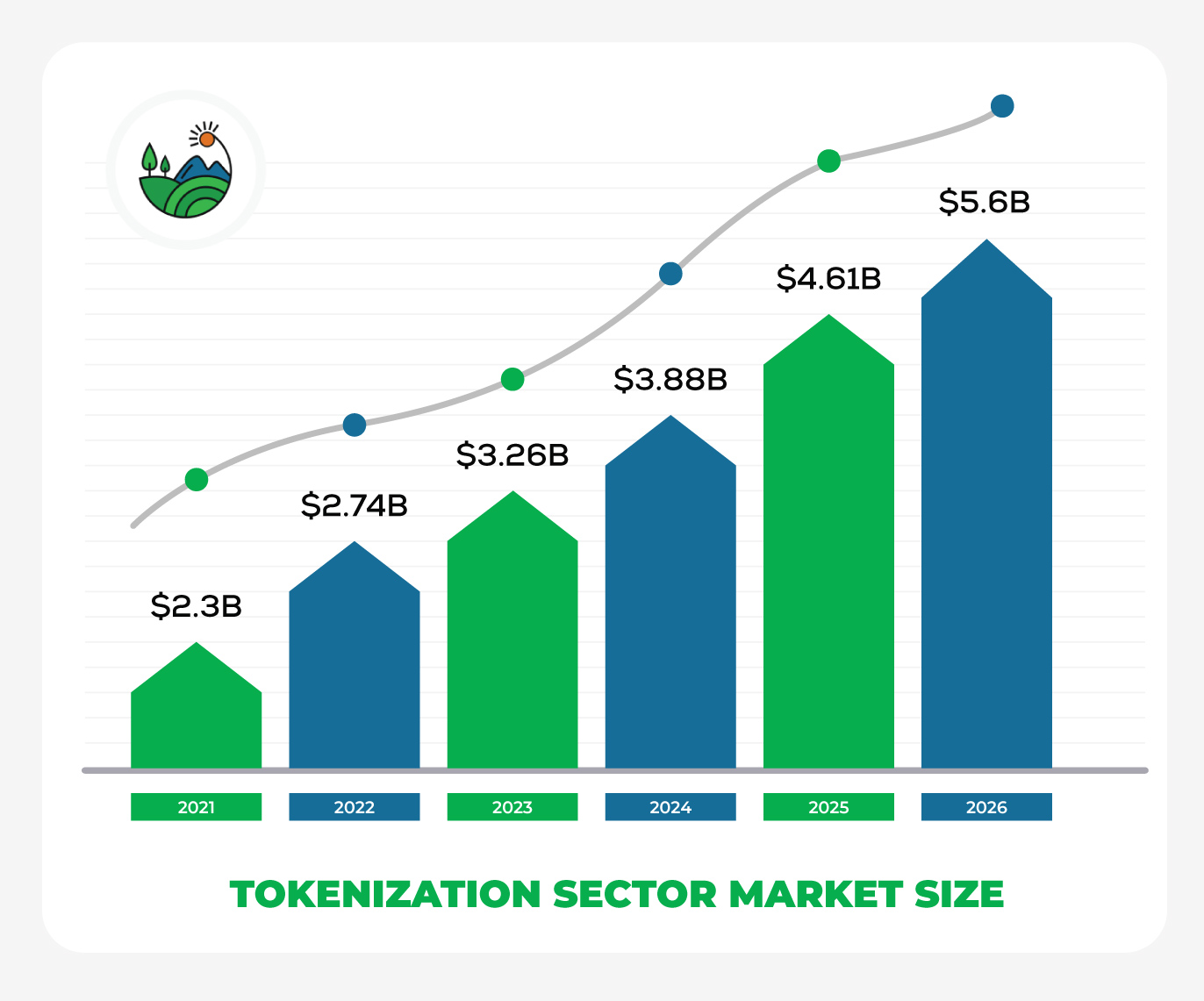

The market size of tokenization was $2.3 Billion by 2021 but the sector is likely to see significant growth in the future given the expected compounded annual growth rate (CAGR) of 19%. The market size could swell up to $5.6 Billion by 2026.

In terms of real estate tokenization, any property can be converted into security tokens over blockchain. These tokens would now represent the value of a unit of real estate property. The popular term for such tokens is Real World Asset (RWA) tokens.

Traditionally, the buying and selling of real estate properties comes with much of a hassle. First up it requires a hefty amount of upfront capital to buy the asset. It takes a lot of time and effort to do paperwork for the property handover. The process is not transparent and there’s always a scope of oversight. Also, there are a lot of constraints for a buyer willing to buy a foreign property.

Tokenization of the real estate market brings unprecedented advantages for one of the biggest investment sectors in the world. Real estate investments are among the few investments with lucrative yet stable returns. The tokenized version brings additional features making it even more attractive.

Tokenized real estate investments are different from traditional real estate investments. However, the differences do not make any one of them superior then the other. Instead, the tokenized real estate is only going to complement the traditional sector. The comparison between the two should clear the picture to a large extent for better understanding.

Though tokenization has noteworthy benefits, there are several challenges in front of the growing sector that needs to be addressed.

Regulatory compliance becomes one of the hurdles in front of real estate tokenization. Since it's an emerging market, the regulatory bodies across the countries might still need some time to come up with regulations to keep the scrutiny without compromising on the sector's growth.

Akin to regulatory compliance, the newness of the tokenized real estate market makes it relatively tough for people to accept. The financial markets are still figuring out and may take time to completely trust and accept the new investment vehicle.

The global real estate market is expected to hit a staggering value of $637.8 Trillion in 2024. The projected annual growth rate is 3.4% CAGR. And considering the expected growth rate, the real estate market is going to be worth $729.4 Trillion by 2028.

A report by the World Economic Forum predicted that by 2027, 10% of the world's GDP will be tokenized — with a significant portion of this potentially in the real estate sector. To put this into perspective, world GDP in 2027 is expected to hit $130 Trillion and hence the tokenized asset market will be worth around $13 Trillion. This number suggests a huge growth potential for the tokenized market in the coming years.

The Landshare Ecosystem takes a unique approach to tokenized real estate, combining the benefits of RWA investment with the opportunities provided by DeFi features such as staking and LP Farming.

Our approach to the real estate tokenization market is underscored by our unique selling propositions, reflecting both innovation and reliability. The successful sale of three properties on the Binance Smart Chain (BSC) serves as a concrete demonstration of our operational capabilities and market acceptance.

Furthermore, the launch of our Real World Asset (RWA) token, Landshare RWA ($LSRWA), introduces new avenues for investors seeking diversification and passive income. RWA tokens represent a pool of properties for you to invest in at once, reducing risk through diversification.

For instance, we acquire a real estate property in Cleveland for $118,000 and add the asset to the RWA Pool. Each RWA Token represents a share of the total pool, providing a clear and tangible stake in the investment.

Our native utility token, $LAND, plays a crucial role in transactions and operations across the platform.

In addition to the core advantages of tokenized real estate, we bring forth extra features for DeFi-centric users. By staking the $LAND token, investors can earn 12% APR, while engaging in staking with $LAND-$BNB LP presents the potential for rewards up to 66%.

The financial markets are undergoing a transformative shift with the advent of technologies like blockchain, particularly in the real estate sector. Landshare and similar platforms are at the forefront, merging blockchain with real estate to enhance accessibility, efficiency, and transparency.

Tokenization is revolutionizing investment by making real estate more accessible and liquid, signaling a future where investing in tangible assets is more democratized. We, at Landshare, are playing our role in this evolution, demonstrating the potential of tokenized real estate and its significant economic implications. This movement isn't just a trend but a pivotal change set to redefine investment landscapes globally.