Landshare Team

As the year winds down, we’re immensely grateful to our dedicated community members, collaborators, partners, and everyone who has worked with us as pioneers in the RWA space. 2023 was a year to remember for Landshare, and we have even bigger ambitions for 2024!

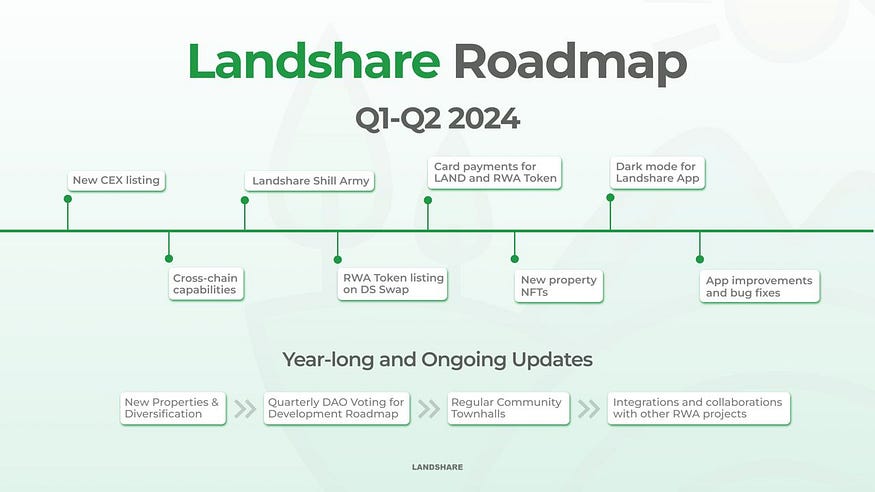

In this article, we’re capping off 2023 by celebrating the year’s top achievements, outlining our core priorities going forward, and providing a detailed roadmap for the first half of 2024. Let’s dive in!

Early this year, we completed the first ever tokenized house flip, netting a 10%+ ROI in just a few months for our participants. In this process, we transformed a distressed property into something brand new, drastically increasing the property value. You can read about the renovation from start to finish in our Follow the Flip series.

This year also marked the launch of the Landshare DAO, which puts high-level decisions into the hands of LAND holders through a decentralized governance model. With this feature, LAND holders can control token emissions, staking rewards, treasury funds, and launch marketing initiatives autonomously.

To learn more about the Landshare DAO and how you can help shape the future of Landshare, be sure to check out our Deep Dive article and the Landshare Docs.

At the end of September, we launched an extensive community incentive program with a prize pool of 35,000 LAND tokens. During this period, we achieved 2.5 million impressions on social media, gained 1200 new token holders, received over 3000 registrations on the DS Dashboard, and welcomed several thousand new followers on X and Telegram community members.

This Friday, December 29th, we officially conclude the Zealy Sprint, marking the completion of the Real World Explorers program. The top 215 leaderboard participants will receive delightful New Year gifts from a 4,000 LAND prize pool.

We thank each explorer for their contributions and eagerly anticipate the opportunity to share what we have in store for the Landshare Shill Army.

To finish 2023 with a bang, we released our most ambitious update yet — the Landshare RWA Token!

With this new token, we’ve fundamentally reimagined our tokenization model, establishing a simple and secure way to gain exposure to real estate directly on-chain. Along with the new Token, we’ve introduced on-chain property valuations via Chainlink, new secondary trading market options, a UI/UX overhaul, and substantial improvements to the NFT ecosystem.

For more information about the RWA Token Update, be sure to check out the following resources:

With the final days of 2023 ticking away, we’re setting our sights on the agenda for the new year. We have established 4 Core Priorities for 2024, each of which will guide our decisions throughout the year. Our roadmap is built as an extension of these priorities, with each item serving to advance one or more of them.

Over time, we have discovered that the most effective way to increase visibility and engagement with the platform is through grassroots, community driven programs and insightful write-ups from Key Opinion Leaders across multiple platforms. To this end, we’re crafting several new initiatives designed to increase visibility and leverage the power of community.

As part of the Real-World Explorer program, we frequently conduct shilling quests where users share information about Landshare, thereby boosting awareness of our updates and events. While this approach has been effective, we recognized the need for a modernized version, and that’s exactly what we’ve achieved with the Shilling Army.

We’re now going beyond mere likes and retweets, delving into more meaningful engagement. We’ve created distinct categories for creatives, influencers, shillers, and a plethora of user-generated content that will be ready to launch in mid-January. More details about this campaign, including information on how to participate and fulfill requirements, will be shared tentatively on January 16. Stay tuned so you don’t miss out.

As many influential voices in the crypto space focus in on the RWA narrative, it’s crucial to continue our work with Key Opinion leaders across the crypto space. We are focused on creators who craft well-researched, highly informative content which clearly highlights the benefits of our platform in a way that is accessible to a wide audience.

Many of our community members may be familiar with the DAO Grant Program and content creation contests. In 2024, we’ll be doubling down our efforts, engaging community members and up-and-coming content creators to produce high-quality, insightful content across multiple domains.

Next up, we must ensure that the platform’s features are easily accessible and well-integrated with other projects. By breaking down barriers to entry and expanding integrations, we make it easier to get into Landshare and even improve the project’s visibility in the process.

Although decentralized exchanges (DEXes) like Pancakeswap are a backbone of DeFi, many users prefer centralized exchanges as a way to buy and sell tokens. To make it easier for these users to get started with Landshare, we intend to list the LAND token on a new centralized exchange early in the year. This will not only allow us to reach more users, but also improve liquidity and opportunities for existing LAND holders.

As crypto moves to an increasingly multi-chain and cross-chain future, it’s imperative that our platform features are accessible through multiple chains. Cross-chain is one of our top priorities, and has been on the radar for a long time. With our latest platform updates as well as new advancements in cross-chain protocols, we have finally established a clear path towards a multi-chain Landshare ecosystem.

With cross-chain comes multiple benefits, including new partnership opportunities, wider access to platform features, and enhanced security. As one of our top priorities for H1 2024, we will continue to provide updates on the development of this feature, including a deep dive article in the coming weeks.

After taking a major step forward with on-chain valuations [link] and fixed price liquidity for RWA Tokens, we will further expand secondary market options with a DS Swap listing for LSRWA. DS Swap will enable the exchange of LSRWA in an active secondary market, similar to Pancakeswap or Uniswap.

Funding a Web3 wallet like Metamask can be a major hurdle for DeFi newcomers. In order to smooth out the onboarding process, we intend to enable credit and debit card payment options for the LAND Token.

Our development will also be hard at work crafting new features and updates for the Landshare App. In addition to some new features yet to be announced, here are the top priorities for our development team entering in the new year.

In the very near future, we will be completing the NFT migration process for existing NFT holders. With the new system, RWA Token Holders will be stack multiple NFTs for a single yield multiplier against their staked RWA Tokens.

Shortly thereafter, we will release our 3rd NFT for the newest Landshare property, LSCH. With this launch will also come a number of promotions and events designed to bring new users into the Landshare NFT ecosystem. With all 3 NFTs in possession, RWA Token holders can earn 40%+ APR in addition to the gains from rental yields and appreciation!

Dark mode has been a commonly requested feature and was passed via DAO proposal with an 81% vote. Accordingly, we will be launching this feature for the Landshare App early in the year.

Our recent Bug Bounty produced some excellent reports and feedback from the community. Our development team will be hard at work fixing existing bugs and making improvements to the Landshare App based on the feedback provided.

Bringing LAND and LSRWA to multiple chains is beneficial unto itself, but far less valuable if key features like staking, governance, and NFTs are not available on those other chains as well. As part of our cross-chain strategy, we will be working to ensure each of our core features has seamless cross chain interoperability, so whether you’re on BSC or another network, everything will work exactly the same.

The Landshare DAO has received several feature requests, and we want to create a streamlined way for LAND Holders to have a direct impact on the development roadmap. Starting at the end of Q1, the development team will assemble all feature requests from the DAO, as well as other ideas from the team or community, and create a single proposal which allows the community to vote for their top priorities.

Unlike a simple Yes/No proposal, the Quarterly DAO Vote will allow you to distribute your voting power across multiple options, based on how important you feel they are. The development team will then assess the results and use them to prioritize development resources, with the top vote-getters receiving special attention. This is a way for the community to provide direct feedback on our development roadmap and request new features for the platform, and a way for the development team to deliver on the community’s top concerns in a timely manner.

Last but not least, our 4th Core Priority is all about expanding and diversifying the real estate offerings for RWA Token holders. By expanding our selection, we not only reduce risk through diversification but also appeal to a wider range of potential investors.

To this point, we’ve focused on single family rentals and house flips. While we do intend to continue investing in these areas, we will be exploring several new options as well. By expanding our selection, we not only reduce risk through diversification but also appeal to a wider range of potential investors.

Some examples we’re exploring include short-term rentals, multi-unit properties, and mixed-use properties. The new RWA Token model also gives us the flexibility to try different strategies, including fix and hold projects or appreciation plays. Each type of investment comes with its own pros and cons, so we’ll continue to assess the market to find the best fit for our investors.

As the RWA narrative captivates the crypto landscape, our sights are set on a new year marked by extraordinary growth. This roadmap serves as a launchpad for what lies ahead, and we invite you to join us at our Community Town Hall on December 29th at 12 PM CST, and be sure to submit your questions here. Your insights will help shape the future, so let’s unite and propel Landshare to new heights in 2024 — our biggest year yet!

Follow Landshare:

Twitter | Medium | Youtube | Telegram | Telegram Announcements | Coinmarketcap | Zealy

Landshare Team

As blockchain technology matures, its potential extends beyond digital currencies into the broader domain of tokenizing real-world assets (RWAs). From real estate to artworks and even intellectual property, the ability to tokenize physical assets has opened up new possibilities for investment, ownership, and exchange.

A Boston Consulting Group report stated that the market size of the on-chain RWA market is expected to hit $16 Trillion by 2030. The massive market size showcases enormous possibilities for growth in the future.

The evolution of technology towards a tokenized economy requires robust cross-chain technologies that facilitate seamless interoperability among diverse blockchain platforms. Here, we will explore what a tokenized economy looks like, why tokenizing real-world assets is transformative, and the crucial role of cross-chain solutions in this burgeoning ecosystem.

Tokenization involves converting the rights to an asset into a digital token on a blockchain. These tokens represent ownership or a claim to the underlying asset, allowing them to be bought, sold, or traded on digital platforms. The process democratizes access to investment opportunities and enhances liquidity, transparency, and efficiency in transactions.

Almost every other tangible financial asset can be tokenized today. Thanks to blockchain technology, commodities, currencies, real estate properties, arts, and many other similar assets can be traded in their tokenized versions. The concept of tokenization gained popularity quickly, and a huge amount of credit goes to the benefits it brings to the table.

Increased Liquidity: Tokenization can transform traditionally illiquid assets like real estate or art into divisible and easily tradable tokens. This broadens the market and reduces entry barriers for investors, making the asset more tradable and, hence, comparatively more liquid. For example, platforms like Landshare allow investors to purchase fractions of real estate properties as tokens, which they can sell on secondary markets without the need for lengthy and complex real estate transactions. This method greatly enhances liquidity in a market traditionally dominated by high thresholds for entry and exit.

Enhanced Transparency: Using blockchain ensures that all transactions are recorded on an immutable ledger, reducing the risk of fraud and increasing trust. For instance, the buying and selling of real estate properties have traditionally been opaque processes with layers of brokers, inspectors, and legal checks. However, with tokenized real estate transactions, every transaction from initial purchase to subsequent sales is recorded transparently on the blockchain.

Streamlined Processes With Automation: Blockchain technology can automate many of the processes involved in asset management through smart contracts, reducing the need for intermediaries and lowering transaction costs. The process is on-chain and requires no paperwork, which resolves a huge issue inherent to the trade of tangible assets like real estate. A notable example here is Maecenas, which allows users to buy and sell shares in fine art using blockchain. This system eliminates the need for auction houses and brokers, thereby reducing fees and streamlining the entire investment process in art, a market traditionally inaccessible to average investors due to high costs and complex buying processes.

With the evolution of blockchain technology, the space is filled with many blockchain networks with distinct properties. It was important that these chains connected to each other to create a unified ecosystem, and that’s where Cross-chain systems came to the rescue.

Cross-chain technology enables blockchain networks to communicate and share information, assets, and value. This interoperability allows users to transact across various blockchains without the need to exchange tokens through a central exchange, enhancing the efficiency and scalability of blockchain applications by connecting otherwise isolated networks.

For instance, Polygon (MATIC) offers extensive cross-chain capabilities through its Polygon Bridge, enabling seamless asset transfers between the Ethereum (ETH) blockchain and Polygon sidechains. This feature supports the movement of ERC tokens, NFTs, and other digital assets, facilitating interoperability and scalability. By using Polygon's cross-chain bridges, users benefit from faster transaction speeds and lower fees compared to Ethereum's mainnet, while maintaining robust security.

Arbitrum (ARB) is another example where the Layer 2 scaling solution for Ethereum enhances its cross-chain capabilities primarily through compatibility with Ethereum's network. It allows users to execute Ethereum transactions more swiftly and at a lower cost, without sacrificing security. While it operates on top of Ethereum, Arbitrum doesn't have a native cross-chain bridge like Polygon but leverages Ethereum's security and connectivity.

Cross chain systems bring these benefits to the RWA sector further enhancing its reach. Tokenized assets could move across blockchain networks rather than limited to the native blockchain only. More the reach to multiple blockchains the more users it can cater.

Broader Market Access: RWA investors benefit from cross-chain systems by gaining access to a wider range of tokenized assets across multiple blockchains, optimizing their investment strategies. This not only broadens their market reach but also enhances liquidity in the RWA sector by including a diverse pool of investors.

Reduced Risk of Fragmentation: Cross-chain technology ensures interoperability across different blockchains, preventing market fragmentation and fostering a more unified ecosystem. Connectivity makes RWAs more accessible and prevents projects within the RWA sector from being isolated on single platforms, promoting broader adoption and integration.

Enhanced Scalability: Cross-chain solutions address scalability challenges that single blockchains face by distributing the load among multiple networks. The utilization of various networks’ strengths leads to more efficient handling of transactions and interactions, significantly enhancing the performance and scalability of RWA applications.

A significant advancement in cross-chain technology is the development of blockchain bridges, such as Polkadot and Cosmos, which aim to connect disparate blockchains to enable asset and data transfer. When the tech is integrated with the RWA sector, it brings significant results.

Cross-chain technology significantly enhances the Real World Asset (RWA) sector by improving liquidity and market access. By enabling seamless transactions across various blockchains, it allows investors to diversify their portfolios with a broader range of tokenized assets, such as real estate or commodities.

The volume of tokenized real estate assets like to increase largely due to improved interoperability provided by cross-chain platforms. This technology also reduces market fragmentation, creating a more cohesive and robust investment landscape, which further attracts a larger pool of global investors, driving the sector's growth and stability.

Cross-chain technology is crucial in the context of RWA because it enables interoperability between different blockchain platforms. This means that assets can move seamlessly across various blockchain networks, enhancing the functionality and reach of tokenized assets. Each blockchain would operate in isolation without cross-chain capabilities, limiting the potential for a truly global and integrated tokenized economy.

As more assets get tokenized on various blockchain platforms, interoperability becomes crucial. Cross-chain technology allows different blockchains to communicate and share information, enabling tokens and assets to move freely across diverse networks.

Integrating cross-chain technologies with tokenization efforts will likely redefine asset management and investment across multiple sectors. As regulatory frameworks evolve to accommodate these innovations, we can anticipate a more inclusive and efficient global market landscape.

As assets from real estate to artwork are tokenized, they become more accessible and liquid. Tokenization could unlock trillions in illiquid assets, significantly expanding global investment opportunities. According to a forecast by the World Economic Forum, the tokenized assets market could exceed $24 trillion by 2027.

Integration of multichain systems will enable these tokens to operate across different blockchain platforms, enhancing the functionality and reach of each tokenized asset. This interoperability is critical to building a seamless, efficient global marketplace, bridging diverse economic sectors and geographies, and setting the stage for a more inclusive financial ecosystem.

The potential of a tokenized economy facilitated by cross-chain technology represents a significant shift in how we perceive asset ownership and investment. As this ecosystem continues to evolve, it promises to bring more inclusivity, efficiency, and transparency to the global economy. The journey towards a fully integrated tokenized world is complex and fraught with challenges, but the benefits could redefine the economic landscape for future generations.

Landshare is a platform for tokenizing property in the United States. It allows investors to buy shares in residential properties through blockchain tokens. This method has simplified the investment process and made real estate investment accessible to a broader audience. Landshare merges blockchain technology with the real estate sector by offering tokenized real estate assets on its platform, enabling investments as low as $50 and democratizing access to property investment.

The platform utilizes Real World Asset (LSRWA) tokens to offer investors shared ownership in actual property assets, which is a significant innovation in real estate investment. Landshare's utility token, LAND, has proven its transactional efficiency with the successful sale of four tokenized properties on the Binance Smart Chain (BSC), showcasing its market readiness. By addressing inefficiencies and liquidity challenges in traditional real estate, Landshare is emerging as a pivotal player, providing attractive opportunities for growth and passive income.

Landshare Team

The advent of blockchain technology heralds a seismic shift in the real estate sector, promising unparalleled liquidity and accessibility through tokenizing real-world assets (RWAs). Traditionally we have seen the real estate sector as an illiquid asset class with high entry barriers but now it is reimagined by integrating on-chain secondary market trading of RWA tokens.

According to CoinMarketCap, the market cap of real-world asset (RWA) tokens stands above $53.7 Billion. This substantial market cap shows us that the RWA sector in the crypto market is proliferating. The high pace of growth ensures that it will soon overlay a notable portion of the traditional real estate market.

We can see how the RWA narrative has taken crypto space by the storm, and it has made a massive leap in the financial landscape. It is making tangible financial assets such as real estate investments more fluid, transparent, and accessible to a broader spectrum of investors. The amalgamation of RWA tokens with secondary market trading brings unprecedented advantages for you in the highly lucrative real estate investment sector.

We can understand secondary market trading as trading of assets among buyers and sellers rather than with the companies or projects. A budding project in the crypto space launches a token through either an ICO, IEO, or IDO, which primarily trades native tokens in exchange of raising funds from investors. After the launch, when these tokens are up for trade among traders, it becomes a secondary market, and the trading becomes secondary market trading.

NYSE and NASDAQ are, for instance, secondary market trading platforms, as they offer you to trade or invest in stocks. On the same note, trading on both centralized and decentralized crypto exchanges falls within secondary market trading. We can trade Bitcoin on crypto exchanges such as Coinbase or buy or sell Ethereum on decentralized exchanges like Uniswap.

Real-world assets (RWAs) refer to objects possessing tangible or intangible value, including but not limited to gold, fine art, and real estate. In 2024, the scope of these assets linked to the real world is set to broaden beyond the confines of physical space. The advancement of blockchain technology makes the expansion possessive, providing a unique on-chain identity to traditional assets. This innovation creates a novel concept known as the real-world asset token.

The global real estate market is over $630 Trillion today and is continually growing. It is expected to hit $729 Trillion by 2028. This also makes real estate investments one of the most lucrative investment vehicles due to huge returns, but they do come with their own shares of hassle.

The real estate market is illiquid, and even a single transaction of buying or selling a property could take weeks or even months. In addition, it takes time to complete the extensive paperwork required for a transaction, making the whole process inefficient.

With the introduction of real estate-backed RWA tokens, real estate property transactions can now be carried out faster, more transparently, and more efficiently. There's more to the phenomenon than just that; let's delve into the benefits of trading RWA tokens in secondary markets.

As mentioned above, the RWA crypto tokens already have a market cap of billions of dollars. Several projects are spearheading change within the space with unique propositions and offerings.

Landshare ($LAND) is among the rare projects that offer real estate-backed RWA tokens: Landshare RWA ($LSRWA). $LAND is the native utility and governance token that takes care of transactions and other operations over the platform.

The RWA token represents the unit of the pool of real estate properties 1:1. Landshare makes it possible for you to step into tokenized real estate investments with as low as $1. Landshare RWA tokens are playing a crucial role in changing the real estate investment landscape with unique propositions and offerings.

Landshare is actively tackling the challenge of the lack of secondary trading options for most security tokens with a comprehensive three-pronged approach. The strategy includes on-chain valuations, ensuring transparency with up-to-date property valuations and cash reserves; fixed price liquidity, maintaining token value alignment with the underlying assets through controlled sales; and DEX Trading, aiming to foster a vibrant secondary market for LSRWA tokens by enabling unrestricted trading.

The upcoming listing of LSRWA Tokens on the DS Swap Security Token DEX is a significant milestone in this endeavor for Landshare. The on-chain real estate trading by offering instant settlements, no transaction fees, and the flexibility to trade against LAND or stablecoin pairs will be possible and it's a paradigm shift in making.

The introduction of the DS Swap listing is expected to amplify trading dynamics by providing zero-fee liquidity pools, facilitating arbitrage opportunities, and allowing for higher trading limits. Landshare takes a leap in resolving the liquidity issues with the DS Swap Security Token DEX listing, promising a more fluid and accessible market for real estate tokenization.

Further enriching the ecosystem, Landshare plans to propose an LSRWA-USD liquidity pool, akin to the successful LAND-BNB LP, to incentivize LSRWA holders with rewards for contributing to liquidity. This initiative not only aims to elevate LSRWA's utility but also to broaden the trader base, mitigate price volatility, and ensure a more stable and liquid market environment.

The Path Forward: Innovation and Opportunities

The tokenization of real estate assets paves the way for innovative investment models and financing mechanisms, from crowdfunded investments to yield-generating real estate funds. These developments promise to enrich the investment landscape and provide property owners and developers with novel avenues for funding and growth.

The listing of LSRWA Tokens on the DS Swap Security Token DEX represents a pivotal moment for Landshare, a huge change in on-chain real estate trading. Enabling instant settlements, zero transaction fees, and versatile trading against LAND or stablecoin pairs, this step will bring unprecedented liquidity in the space. It amplifies trading dynamics with zero-fee liquidity pools, arbitrage opportunities, and higher trading limits, marking a significant step towards solving liquidity issues and enhancing the accessibility of real estate tokenization.

RWA tokens' on-chain secondary market trading sets the stage for a more liquid, inclusive, and dynamic real estate market. By leveraging the power of blockchain technology, the real estate sector is poised for a transformation that promises to redefine the essence of property investment, making it more accessible, efficient, and attractive to a global audience of investors.

The future of real estate investment is not just about owning property; it's about being part of a revolutionary movement toward a more democratized financial ecosystem.

Landshare Team

The world is moving fast and every now and then we see disruption in traditional industries by emerging technologies. Blockchain is undoubtedly a state-of-the-art technology which is changing the landscape across the industries. It keeps changing the fundamental operations and bringing better and efficient solutions. Tokenization of Real World Assets (RWAs) is possible due to blockchain technology and is on the way to becoming a trillion dollar industry.

The RWAs could include a wide range of assets from the tangible financial or traditional physical world including real estate, commodities, artifacts, or even the digital tokens, the list goes on for real world assets. Although we are witnessing that the tokenization sector is on boom and spreading across different sectors, it is making a notable difference in real estate. A significant number of projects have surfaced in recent years that focus on tokenization of the real estate sector.

Industry experts have recognized tokenization as an enterprise blockchain solution with huge potential in the future. Co-founder of crypto exchange Coinbase Fred Ehsram quotes that “Everything will be tokenized and connected by a blockchain one day.”

Tokenization is a process of representing the value of real world assets on blockchain. When an asset is represented as a digital token that can be exchanged and kept on a blockchain, this process is known as tokenization. We do not need middlemen, while secure and transparent record-keeping is made possible by distributed ledger technology, or blockchain.

Real World Assets (RWAs) includes tangible assets such as real estate properties and art pieces, financial instruments such as commodities, bonds, and equities and intangible assets intellectual property, data and identity.

Data suggests that RWA tokenization emerged as a fast-paced segment across the DeFi space. According to DefiLlama, in December 2023, the RWA tokenization was sitting on total value locked (TVL) of around $5 Billion.

Increased liquidity, fractional ownership, and easier transferability are just a few advantages that blockchain-based tokenization offers over conventional asset ownership and trade. Tokenized assets can be exchanged anywhere in the world, at any time, and without middlemen, which lowers expenses and expands the pool of possible investments.

Though tokenization is a typical procedure with technological aspects, still here we try to give a simple explanation. The tokenization process begins with determining the best method to digitize the chosen asset, which varies based on the asset's nature, such as a money market fund versus a carbon credit, and its classification as either a security or a commodity under relevant laws.

Next, if the asset has a tangible form, it is secured in a mutually agreed-upon location. Following this, a token representing the asset is created on a blockchain, with necessary compliance measures in place. This digital asset is then ready for distribution, requiring investors to use a digital wallet for storage and possibly trade on a secondary market with less stringent regulations.

Post-distribution, the asset undergoes continuous management, including compliance with legal and financial reporting, to ensure its integrity and value are maintained.

RWA Tokenization is taking the world by storm and there are a number of reasons behind it in the form of benefits and offerings. It solves many inherent issues across the sectors along with bringing new age solutions. The solutions not only saves cost and efforts but end up making the traditional procedure more efficient and easy. Let’s talk about the advantages of RWA tokenization in depth.

Accelerated Settlements Through Constant Availability: Traditional financial settlements typically take up to few business days to complete, allowing time for all parties to prepare necessary documents and funds. Tokenization enables immediate settlements, offering potential savings, especially in environments with high interest rates, by facilitating round-the-clock transactions.

Reduction in Operational Expenses with Programmable Assets: Tokenization brings significant cost reductions in asset management, particularly for assets that traditionally require extensive manual intervention, like corporate bonds. By integrating functions such as interest computation and payment distributions into a token’s smart contract, these processes become automated, minimizing the need for manual oversight.

Opening Investment Opportunities to a Wider Audience: The efficiency gained from automating complex and labor-intensive processes makes it financially viable to serve a broader range of investors, including those with smaller capital. However, for this democratization to fully materialize, the distribution of tokenized assets must expand substantially.

Boosted Transparency Through Smart Contracts: The deployment of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, enhances the transparency of transactions. For instance, in the case of tokenized carbon credits, the blockchain can maintain a clear, unchangeable record of the credits' ownership and transactions.

More Flexible and Cost-effective Infrastructure: Leveraging blockchain technology, which is open source by nature, results in a more adaptable and less expensive infrastructure compared to traditional financial systems. This aspect of blockchain facilitates quicker adjustments to meet evolving regulations or operational demands.

The landscape of RWA tokenization, or digitizing tangible assets through blockchain, is at a foundational stage with a promising outlook. As the underlying blockchain technology evolves and legal frameworks become more defined, this area is poised for notable expansion. RWA tokenization issuance is forecasted to reach $4 to $5 trillion by 2030.

Here's a snapshot of emerging trends in the realm of RWA tokenization:

Wider Acceptance: Anticipate a surge in the embrace of this innovation across diverse industries. Companies leveraging this approach stand to gain by making assets more liquid, slashing operational expenses, and widening the pool of potential investors.

Legal Frameworks Gaining Shape: The growth trajectory of RWA tokenization hinges on clear legal guidelines. Authorities are progressively understanding the value of these digital assets and are crafting laws to safeguard investors while promoting creative advancements.

Cross-Platform Exchangeability: The fluid exchange of tokenized assets among various blockchains and platforms is essential for the sector's vitality. Efforts are underway to establish norms and protocols that enable such seamless transfers, aiming to boost market liquidity and effectiveness.

Security Enhancements: With the rise in the value of digital assets, enforcing stringent security protocols is becoming increasingly crucial. Cutting-edge solutions, including decentralized verification and layered authentication measures, are being developed to fortify the safety of these assets.

DeFi Convergence: The intersection of RWA tokenization with the burgeoning sector of DeFi heralds the creation of innovative financial mechanisms. This amalgamation is set to offer unprecedented opportunities for decentralized financial activities, from lending and borrowing to generating passive income.

These evolving dynamics suggest a transformative phase for the tokenization of real assets, promising to redefine the contours of asset management and investment through increased accessibility, security, and market fluidity.

There are a number of industries that saw a significant interest in tokenization of assets. The real estate sector has swiftly acknowledged the advantages offered by tokenizing. Transforming tangible real estate into digital tokens enhances trading efficiency and liquidity. This innovation provides investors with fresh opportunities, reduces entry obstacles, and enables partial ownership of premium properties.

In addition to real estate, tokenization is transforming investment in art, collectibles, private equity, commodities, and venture capital. It democratizes access to high-value art and collectibles by allowing fractional ownership through digital tokens, enhancing portfolio diversification.

In private equity, it streamlines capital raising and increases asset liquidity, making it easier for investors to trade shares in private companies. For commodities like gold and oil, tokenization offers a simplified trading mechanism, bypassing the need for physical handling. In venture capital, tokenizing startup equity facilitates capital raising and provides early-stage investors with liquidity, allowing them to realize returns without waiting for traditional exit events.

Avalanche is emerging as a key player in the RWA tokenization space, attracting major banks like JP Morgan, Citi, and Bank of America. These institutions are leveraging Avalanche's technology and Subnets to develop blockchain solutions for tokenizing funds, facilitating forex trades, and exploring broader asset tokenization opportunities.

Chainlink plays a crucial role in the tokenization of real-world assets, offering transparency, cost-effectiveness, and accessibility in financial transactions. Research by K33 highlights Chainlink's LINK as a secure choice for investors interested in RWAs' tokenization. Chainlink's platform enables the enrichment of RWAs with real-world data, secure cross-chain transfers, and connection to off-chain data, making it a key player in this emerging landscape.

The real estate sector market is one of the fastest growing industries worldwide. Statista report states that in 2021, the global real estate market size stood at $585 Trillion. It is expected to be a staggering $729.4 Trillion in 2028 with a CAGR of 3.4%.

Given the sheer size of the industry, tokenization of real estate has a huge potential in the near future. There are several projects already active in the space leading the way for the industry. We at Landshare intend to unlock the vast prospect of real estate for the masses.

Landshare stands out in the real estate tokenization sphere through its innovative and reliable unique selling points. Our ability to successfully sell three properties via the Binance Smart Chain (BSC) highlights our operational proficiency and the market's endorsement of our approach.

The introduction of our Real World Asset (RWA) token, Landshare RWA ($LSRWA), opens up new opportunities for investors aiming for diversification and passive income. This token allows investors to access a selection of properties. Our platform's functionality and transactions are significantly supported by our native utility token, $LAND.

Beyond the fundamental benefits of tokenized real estate, we offer additional perks that enhance its appeal. Holding $LAND enables us to offer investors returns over 12%, while participating in $LAND-$BNB LP stake can yield rewards as high as 66%. Landshare's commitment to innovation, security, and profitability continues to propel us forward in the tokenized real estate market.

Real estate tokenization transforms property investment and management through several key benefits:

Enhanced Liquidity: Tokenizing real estate allows for the fractional buying and selling of property interests, significantly increasing market liquidity. This process enables smaller investments and makes it easier for owners to sell parts of their assets quickly, offering flexibility previously unseen in the traditional real estate market.

Accessible Fractional Ownership and Diverse Portfolio Opportunities: Democratization of real estate investment becomes possible by lowering entry barriers and enabling portfolio diversification across various properties and locations, thus reducing risk and potentially enhancing returns for a broader investor base.

Participation in Global Real Estate: Tokenization erases geographical boundaries, enabling global investment in local real estate markets. This not only broadens the investor base but also injects foreign capital into markets, potentially stabilizing property values and encouraging economic diversity.

Efficiency, Transparency and Low Transaction Fees: Tokenization enhances transaction efficiency, reduces costs, and speeds up processes by eliminating traditional bottlenecks and paperwork. It ensures transparency, recording every transaction to minimize fraud risks, thereby building investor trust. Additionally, it cuts down on intermediary fees, making investments more accessible and profitable.

Simplified Asset Management: Digital tokens simplify the management of real estate assets, from leasing to maintenance and sales. This efficiency reduces administrative burdens and costs, potentially increasing the profitability of real estate investments.

These advancements collectively represent a significant shift in how real estate is viewed, traded, and managed, offering unprecedented opportunities for investors and transforming the real estate landscape into a more inclusive, efficient, and secure market.

The tokenization of Real World Assets (RWAs) represents a groundbreaking shift in how we view and manage assets across various industries. With its roots deeply entrenched in blockchain technology, tokenization is paving the way for a more efficient, transparent, and accessible market. The real estate sector, in particular, has seen a remarkable transformation through tokenization, offering benefits like increased liquidity, fractional ownership, and global participation. As we look towards the future, the potential for tokenization extends far beyond real estate, touching every corner of the investment world from art and commodities to intellectual property.

Landshare's initiative in real estate tokenization exemplifies the practical application and immense potential of this innovation, demonstrating how traditional barriers can be dismantled to unlock new investment opportunities. With the global real estate market poised for significant growth, the role of tokenization will undoubtedly expand, bringing with it a host of advancements in how we buy, sell, and manage assets. As industry leaders and pioneers continue to explore and invest in tokenization, the landscape of asset management is set for a revolution, making investment more democratic, secure, and efficient for all.