Tokenization: Crypto’s Most Compelling Use Case

Landshare Team

When someone thinks of cryptocurrency, the first things that come to mind are usually Bitcoin, NFTs, meme coins, or yield farming. Despite the public attention and large sums of money directed toward these applications of the technology, many in the financial sector believe that the most compelling use case is something less widely known — tokenization.

Tokenization is the process of converting an off-chain asset to a token, which becomes the on-chain representation of that asset. Tokenization can be used to fractionalize illiquid assets such as real estate or simply to allow the for the asset to be traded, transferred, or leveraged on the blockchain.

While tokenization is still a new concept, there are a growing number of banks, hedge funds, and governments starting to take notice. In November 2022, J.P. Morgan, DBS Bank and SBI Digital Asset Holdings used on-chain protocols to exchange tokenized government bonds. Following suit, Israel recently announced their intention to begin testing tokenized government bonds as well.

These programs may simply be the tip of the iceberg — there is widespread belief that tokenization may soon disrupt real estate, stock trading, and global commodity markets. But why would traditional financial systems be upended and replaced with tokenization? Let’s take a look at some of the reasons tokenization is viewed as one of the most promising use cases for the blockchain.

Disruption of traditional securities markets

All marketplaces have one goal in common — to become more efficient. Despite this, security markets still rely on an archaic network of banks, brokers, transfer agents, clearing houses, market makers, and more. While many aspects of the process have been digitized and streamlined, the underlying structure remains unchanged from what has been in place for decades. Because of all the moving parts, fees are often high and the transfer of funds in and out of the brokerage can take several days. This is why many, including Blackrock CEO Larry Fink, believe that tokenization is the next logical step for marketplaces to take.

At a recent event, Fink stated that “the next generation for markets, the next generation for securities, will be tokenization of securities.” He went on to say that tokenization can provide “instantaneous settlement” and “reduced fees” by leveraging the blockchain’s distributing ledger system. In addition, the open nature of the blockchain means that trades are transparent, trustless, and the need for intermediaries is largely eliminated.

Fractionalization and digitization of real estate

Buying, selling or transferring real estate requires the need of middlemen, title companies, and lawyers to manage paperwork or act as an escrow between you and a buyer. The system used to buy and sell real estate is largely unchanged from decades ago, relying on a series of manual processes that incur fees at each step.

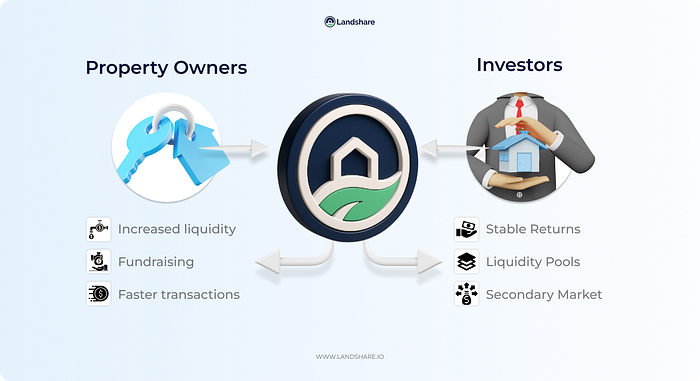

Tokenization can be used to easily fractionalize, securitize, and trade traditionally illiquid assets such as real estate. Turning a real estate asset or development project into easily marketable securities is traditionally only achievable through high-fee brokerages or other investment portals. Tokenization makes this process far easier — fractional real estate securities can be issued on a public blockchain instead, meaning lower minimum investments, access to a global base of investors, and the ability to create a secondary market using smart contracts.

The emerging Tokenized Asset market is currently only valuated at roughly $0.6 billion, but due largely to the potential shown by tokenized real estate, many in the financial sector are bullish on tokenization as a disruptive force. Boston Consulting Group (BCG) is estimating asset tokenization will grow by 2500% by 2030, and the World Economic Forum estimates that tokenized markets could “potentially be worth as much as $24 trillion by 2027”.

The tokenization of “everything”

Tokenization is not limited to stocks and real estate. Virtually anything can be tokenized — natural resources, art, collectibles, currencies, and even carbon credits. This means that a digital marketplace consisting of virtually every asset imaginable, all existing on a single network, is a distinct possibility.

In fact, S&P Global executives have stated “we think the tokenization of everything is going to happen.” The ability to trade any asset in a shared digital space would fundamentally change the way global commodity markets work. Precious metals, energy resources, and agricultural products can all be traded on the blockchain’s distributed digital ledger through tokenization, with instant transfers and settlement anywhere in the world.

Leveraging smart contracts

When assets are tokenized, they exist as on-chain tokens utilizing existing standards such as ERC-20. Put simply, they can interact with smart contracts and DeFi protocols like any native crypto asset. Many crypto-savvy readers may be familiar with loan protocols, staking contracts, perpetual futures trading, and decentralized liquidity pools. When traditional assets are tokenized, they can interact with these protocols — creating brand new investment strategies and streamlining complex transactions.

This is far from a hypothetical use case — as part of the Monetary Authority of Singapore’s Project Guardian, borrow/lend smart contracts utilizing on-chain verification were used to carry out foreign exchange transactions without the need for intermediaries. In one transaction, 10.4 million JPY (roughly $70,000) was transferred with a transaction fee of only $0.03 USD.

Closing thoughts

Key players around the globe are all in agreement — asset tokenization is the future of marketplaces. While some firm’s estimations are loftier than others, it is important to view how these firms are forming their estimates. The World Economic Forum notes that if only 10% of the world’s GDP is tokenized, its market cap would climb to $24 trillion. The Boston Consulting Group agrees with the WEF, noting that the value of tokenized assets could surpass $16 trillion by 2030 if even a fraction of the world’s GDP is tokenized.

The varying projections each firm has comes down to a matter of opinion. Yet, there is widespread belief that adoption will happen; the only point of disagreement is how quickly it will happen. As the world becomes increasingly digital, it stands to reason that traditional systems will look to transition to digitally-native infrastructures. With tokenization, you can transform anything into a trustless, instantaneous, liquid, and fractional asset.

Landshare October Recap

Landshare Team

October was a milestone month for Landshare – one that set the stage for the next era of on-chain real estate. From the official Landshare v2 announcement to new ecosystem updates, governance decisions, and exciting community initiatives, we’ve laid the groundwork for a future defined by growth, utility, and innovation.

This month, we introduced the framework that will redefine how investors, property owners, and DeFi users interact with real estate on-chain. Let’s recap the highlights 👇

Landshare v2 Announcement

The official unveiling of Landshare v2 signaled the start of a new chapter – one built around real utility, real yield, and real scalability.

Landshare v2 isn’t just an upgrade. It’s the foundation of a self-sustaining ecosystem where tokenized real estate finally reaches its full potential. The new system transforms stable assets into active yield-generating opportunities, seamlessly connecting traditional markets to DeFi.

The Three Pillars of Landshare v2

In our follow-up deep dive, we explored the three core pillars that form the foundation of Landshare v2:

- The Real Asset Vault (RAV): A seamless gateway for stablecoin holders to earn real yield backed by tokenized properties.

- The Tokenization Hub: A complete solution for property owners to bring their assets on-chain.

- The DeFi Suite: Tools and incentives that amplify participation and utility across the ecosystem.

Together, these pillars create a self-sustaining growth loop, where every user and property strengthens the entire network.

DAO Proposal Passed

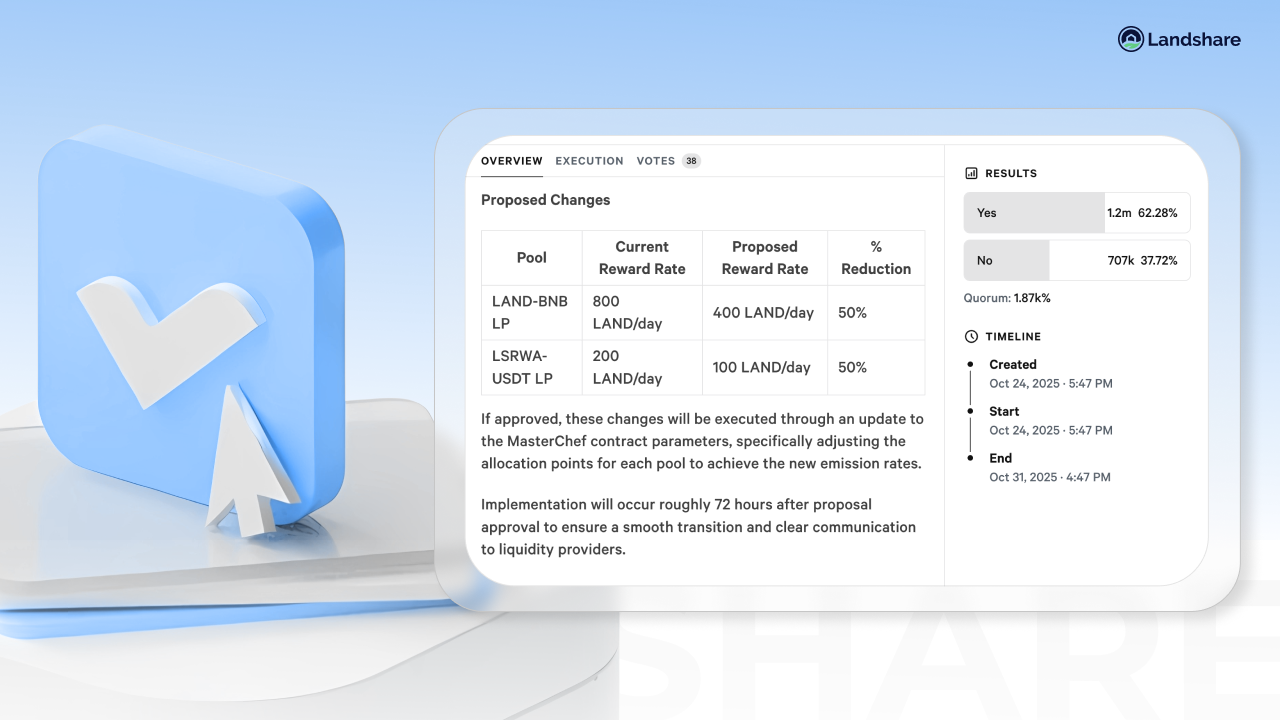

In late October, the community voted to reduce LP emissions by 50% across both the LAND–BNB and LSRWA–USDT pools – with the proposal passing at 62.28% in favor.

This important step helps:

✅ Reduce daily LAND inflation

✅ Strengthen token scarcity and price stability

✅ Extend the reward pool lifespan

✅ Encourage long-term liquidity participation

The change will take effect within 48 hours of approval and marks another move toward a more balanced, sustainable economy for Landshare v2.

🗳️ View the full proposal and results

Tokenization Hub Breakdown

We released a comprehensive guide to the Landshare Tokenization Hub, explaining how property owners can now go beyond simple tokenization to access real investors, liquidity, and on-chain utility.

The Hub bridges traditional real estate with blockchain finance – creating a pathway for real-world assets to generate ongoing yield, transparency, and accessibility.

4.5M+ LAND Staked

October also marked another key milestone – over 4.5 million LAND tokens (nearly half of the total supply) are now staked in vaults. This incredible community achievement reflects growing confidence in Landshare’s long-term vision and token utility.

Community Townhall Incoming

We’re excited to announce our next Community Townhall, happening Thursday, November 6 at 12 PM CST or 6 PM CET on X Spaces!

Join Jordan (CEO), Travis (Co-Founder), and Ivan (CMO) as they discuss everything happening with Landshare v2, recent DAO proposals, and take your questions live.

Looking Ahead

With Landshare v2 on the horizon, the foundation is set for a new phase of growth and adoption. In the coming weeks, we’ll be sharing more details on the RAV launch, the Points Campaign, and other major milestones driving our ecosystem forward.

Stay tuned – the future of real estate is being built on-chain, and we’re just getting started.

Tokenization Hub Breakdown

Landshare Team

Real estate tokenization has been a buzzword for years. Yet in practice, most projects have failed to move beyond press releases and empty promises. Too often, blockchain has been used as a veneer to package illiquid or low-quality assets, leaving investors with tokens that serve little purpose and property owners with no meaningful results.

Without investors, liquidity, or secondary markets, tokenization becomes little more than an on-chain spreadsheet — a digital record of ownership that no one can trade or invest in. For property owners, that means time and money spent “tokenizing” without achieving key goals: raising capital, expanding visibility, or unlocking value.

A Smarter Path Forward

For real estate tokenization to truly work, it needs to deliver tangible investment outcomes. After years of building and refining on-chain real estate products, Landshare has developed a model designed to do exactly that.

The Landshare Tokenization Hub transforms tokenization from a passive concept into an active investment process — connecting high-quality properties with real investors, liquidity pathways, and a live blockchain economy.

The Tokenization Hub Solution

Most platforms stop once a token is created. Landshare’s Tokenization Hub goes further , offering a complete pathway for property owners to bring their assets on-chain and immediately engage investors.

Each project is structured for success from day one, with:

- Customized tokenization models tailored to each property

- Transparent fundraising mechanics with defined soft and hard caps

- Built-in integration with the broader Landshare ecosystem

By connecting directly to Landshare’s existing network of investors and DeFi infrastructure, offerings can attract participation as soon as they launch. Once a fundraising goal is met, property tokens are deposited into the Landshare RWA Pool, linking them to ongoing liquidity, yield mechanisms, and secondary market exposure.

Why This Model Delivers Real Results

Where others leave property owners to manage marketing, compliance, and liquidity alone, the Tokenization Hub handles these as part of a unified process. This integration dramatically increases the likelihood of meeting fundraising goals and sustaining long-term engagement.

Integration with the Landshare RWA Token (LSRWA) is central to this model. Rather than isolated tokens with no market, each property becomes part of a shared, liquid environment that generates yield and investor participation. Individual assets can still be represented, extracted, or traded independently when needed.

For example, a multifamily property owner might tokenize 20% equity to raise $500,000 on-chain, connect the asset to the RWA Pool for ongoing yield, and maintain full transparency for investors — all within a compliant, accessible framework.

How It Works

- Tokenize the Property: Landshare collaborates with property owners to create a digital representation of equity, income rights, or hybrid participation.

- Launch the Offering: The property is listed on the Tokenization Hub with defined terms, caps, and transparent investor access.

- Fundraising & Validation: Investors participate directly on-chain. Once the soft cap is reached, funds are secured and the offering is finalized.

- Ecosystem Integration: Tokens are deposited into the Landshare RWA Pool, and investors receive LSRWA tokens representing pooled value and yield potential.

- Ongoing Value Creation: Property owners gain lasting benefits through liquidity, visibility, and investor engagement. As new assets are added to the pool, owners can rebalance between equity and cash, making real estate a more dynamic and liquid asset than ever before.

Built for Real-World Impact

The Landshare Tokenization Hub is more than a technical service — it’s a complete ecosystem designed to make real estate investment active, liquid, and accessible.

For property owners, it offers a streamlined way to raise capital and connect with global investors.

For investors, it provides exposure to yield-generating, on-chain assets backed by transparent real-world value.

In an industry crowded with static tokens and overhyped promises, the Tokenization Hub delivers what tokenization was always meant to achieve — real outcomes, real liquidity, and real-world results.

🏡 About Landshare

Landshare is a tokenized real estate ecosystem that enables seamless investment in real-world assets on the blockchain. With Landshare, you can own a share of a real-world property simply by holding our RWA Tokens ($LSRWA). Our platform offers a secure, transparent, and efficient way to invest in real estate without traditional barriers.

- Website: landshare.io

- Twitter: @Landshareio

- Community: t.me/landshare

Plume Network's SEC Approval Means RWA Projects Are Closer to the $16T Market

Landshare Team

On October 6, Plume Network announced on its social media that it had been approved to be an SEC-registered transfer agent. This is a big milestone for the RWA industry, signaling that the traditional financial system is welcoming tokenized assets.

Transfer agents basically manage important back-end work and are the official record-keepers for securities issuers. So, essentially, they maintain shareholder registries, record ownership changes, issue certificates, and handle other corporate actions.

Plume’s approval means these critical functions can now be managed on-chain for tokenized securities. This is a pretty big deal, as it gives Plume and its users formal regulatory standing under U.S. law for on-chain securities.

Experts believe that this approval can boost the global RWA market, and top players like Landshare can benefit from it due to the increased regulatory clarity.

Why is the SEC’s Approval Important for Plume Network?

So, first, understand the roles of a registered transfer agent to get a better understanding of its importance.

In traditional finance, a transfer agent is usually a company or bank that tracks who owns a company’s securities and facilitates trades. They ensure every share transfer, stock split, or dividend payment is accurately recorded and reported. Now, let’s understand how this traditional role will work in the world of blockchain.

Post Link

By replicating these roles on-chain, Plume’s platform can securely log every token sale or dividend distribution in an immutable ledger, while also syncing with regulators. As Plume explains, its transfer-agent protocol will “link cap tables and reporting directly to SEC and DTCC systems”.

This means tokenized equity and debt on Plume can behave like traditional securities, but will be managed better with the help of blockchain technology.

Plume’s CEO believes that this regulation “exists to protect investors’ rights as shareholders,” and Plume’s on-chain solution is meant to simplify the processes under that framework.

Its Impact:

Experts believe that the registration will open up several doors for the RWA market because of the ‘trust factor’. Being registered means there are no risks as far as legality is concerned. When an industry or its top player receives a green flag from the government regulatory agencies, institutional capital follows.

BlackRock, Fidelity, JP Morgan, etc., are already looking to build blockchain-based products. This will further invite them to join the RWA growth story and possibly super-boost it.

Moreover, another important benefit is that tokenized securities can now flow through compliance obstacles. This means issuance times can be cut from months to weeks with the help of smart contracts. Similarly, on-chain dividends and ICOs can enjoy the same legal protections as Wall Street offerings.

What Does This Mean For The RWA Market?

Plume’s win comes at a time when analysts are already forecasting a massive growth in tokenized RWAs over the next decade. Institutions now value tokenization as a way to digitize everything from private credit to real estate. Also, the numbers are pretty optimistic as well.

A Boston Consulting Group report estimated the global asset-tokenization market could reach about $16.1 trillion by 2030. The industry has already grown by almost 380% in the past three years. To put things into perspective, today’s entire crypto market cap is smaller than those figures. Even some of the more conservative forecasts still show multi-trillion growth.

If these estimates can materialize in the days to come, RWA is well-positioned to be one of the largest markets in the world of modern finance.

Moreover, the external conditions are favoring this industry. Governments and regulators worldwide are creating proper frameworks. For instance, Asia-Pacific markets are running pilots for digital bonds and crafting standardized rules for security tokens.

These developments and the excitement of retail investors in this category build confidence that the $16T opportunity is actually very real.

How Will Landshare Benefit From This?

Landshare stands at the forefront of benefiting from this opportunity because of its early entry and real-world utility. This is very important as institutions seek new projects that have use cases that can help them capture a considerable market share.

Moreover, Landshare already operates as a compliant RWA platform. For instance, each Landshare RWA Token (LSRWA) is a security token representing fractional shares of a U.S. real estate portfolio, and buyers must pass KYC/AML checks.

The fact that regulators are now approving on-chain transfer agents shows the industry’s efforts are finally paying off. Here are some more factors that can help Landshare be one of the top RWA contenders:

1. Regulatory Credibility: Plume’s SEC status essentially means that tokenized securities can operate within established rules. Landshare’s approach aligns with these principles. So, investors can be assured that their projects sit within a legal framework designed to protect shareholders.

2. Investor Confidence: Every step toward clear regulation lifts confidence. The recently passed GENIUS Act, the SEC’s staff statements on liquid-staking, and the Trump administration’s overall outlook towards the crypto market have been fairly positive.

Similarly, Plume being approved as a SEC-registered blockchain transfer agent tells retail and institutional investors that projects like Landshare aren’t mere experiments. They’re rather a part of a regulated financial evolution.

Moreover, it means regulators see value in on-chain tokens, and that kind of signal helps legitimize the space Landshare operates in.

3. Landshare’s Own Progress: Landshare isn’t about hype. It is rather focused on delivering value from day one. The project has already sold four houses on the BNB chain. It is also providing consistent rental returns to the investors in its properties.

Moreover, the team remains focused on delivering stable, compliant returns from real estate growth.

Conclusion

So, now we know that the recent news was about more than just Plume Network being approved by the SEC to be a transfer agent. It rather has a much bigger impact on the RWA market as a whole.

While the industry continues to grow, for Landshare, it is the right time to innovate further and add more value to consumers’ lives.